What is Tencent Music and how to upload your music to QQ Music, Kugou Music, Kuwo Music and WeSing free

Tencent is the Chinese technology conglomerate behind popular music streaming services QQ Music, Kugou Music, Kuwo Music and WeSing.

QQ Music, Kugou Music, Kuwo Music and WeSing, collectively under Tencent Music Entertainment (TME), are some of the biggest music entertainment platforms in China. These four platforms offer a range of music, audio, karaoke, live streaming, concert services and more, letting users discover, listen, sing, watch, perform and socialize.

As one of the first music distributors partnered with Tencent, RouteNote has offered independent artists and labels an easy way to upload to all of their platforms since 2019. We detail everything you need to know about Tencent Music and how to upload your music for free!

Click below to jump to one of the following:

How to upload to Tencent Music

Getting your music on to all of the music services Tencent Music operates, as well as over one hundred of the most popular music streaming services around the world is super easy and free with RouteNote. Follow the steps below to get started:

- Sign up for a free RouteNote account

- Head to Distribution – Create New Release

- Input all of the relevant metadata, artwork and tracks

- In the Manage Stores page, tick “Tencent” or “Select all stores”

- Here you can also choose pricing for Tencent and other stores – Standard, Lowest, Low or High

To maximize your presence in China, be sure to tick “NetEase” and “Kanjian” too.

Now that your release is finalized, you have to pick between Free and Premium distribution. Free doesn’t cost a penny and allows artists to keep 85% of the royalties. Premium costs a small upfront fee per release and annual cost.

Pricing is on a per-release basis. You are never locked in with RouteNote. You can switch any release between Free and Premium at any time, great for maximizing revenue based on the popularity of a release. We believe in providing the same opportunities to all artists, regardless of their size. The features and stores are the same on both tiers.

We also have a third tier called All Access. With tailored services, dedicated account management, priority support, pitching assistance and early access to new features, All Access is perfect for larger artists and labels. Get in touch to find out more about All Access.

That’s all that’s required of you. Your release will now be sent to our moderation team, who will check over your release for any formatting errors or copyright issues. We aim to get to every release within 72 hours, but this can extend during busy periods. You will receive an email once your release has been approved or if there’s anything that requires your attention.

Once approved, our distribution team will ensure your release is sent to all of the stores and territories you selected when creating your release. After approval, your release will be on most stores within two weeks, while major stores, such as Spotify and Apple Music will usually have content live within 5 days.

Statistics for most stores are paid directly into your RouteNote account monthly, 45 days after the close of each month, with payments available in the next 5 days. For Tencent Music, stats and money will be sent to your account quarterly. Statistics and earning reports break down exactly how much money each track has made in each store and territory. Once you’ve hit the $50 threshold, payments can be securely transferred into a PayPal or bank account.

What is Tencent Music?

Tencent Music Entertainment is the company that runs several music streaming services in China, but what differentiates them, how did they start and where are they now?

How did Tencent Music start?

Tencent Music was founded in 2016 after Tencent purchased China Music Corporation, bringing QQ Music, Kugou Music, Kuwo Music and WeSing under one company.

QQ Music, Kugou Music, Kuwo Music and WeSing’s history stretches back further than 2016. QQ Music and Kuwo Music were launched in 2005, while Kugou Music was launched back in 2004. WeSing arrived later, in 2014.

In Q3 2023, Tencent Music reported 594 million monthly active users, 103 million paying users, and is on track to hit $1.5 billion in earnings in 2023. This places the music streaming company only slightly behind worldwide streaming service Spotify, with 602 million monthly active users in Q4 2023. Tencent Music currently holds about a 70-80% market share in music streaming in China. On subscribers, Tencent is experiencing immense success in this area too, with 102.7 million subscribers, representing a 14.4% market share, despite only operating in China. Since the closure of Xiami Music, Tencent and NetEase Cloud Music have essentially created a duopoly in music streaming in China. These two services control over 90% of all music streaming in China.

Over the years, Tencent Music Entertainment has built relationships with some of the biggest players in the music industry, such as Universal, Sony, Warner, Apple Music, Spotify, Gaana, YG Entertainment, GMM Grammy and Radio Music Warehouse. This at times has caused investigations into Tencent.

Tencent Music Entertainment owns a long-form audio platform – Lazy Audio, and as a collective also manages various services across all platforms, such as B2B services, charitable causes, live concerts, studio spaces, award ceremonies, licensing services and more. See the links below for more information:

The differences between QQ Music, Kugou Music, Kuwo Music and WeSing

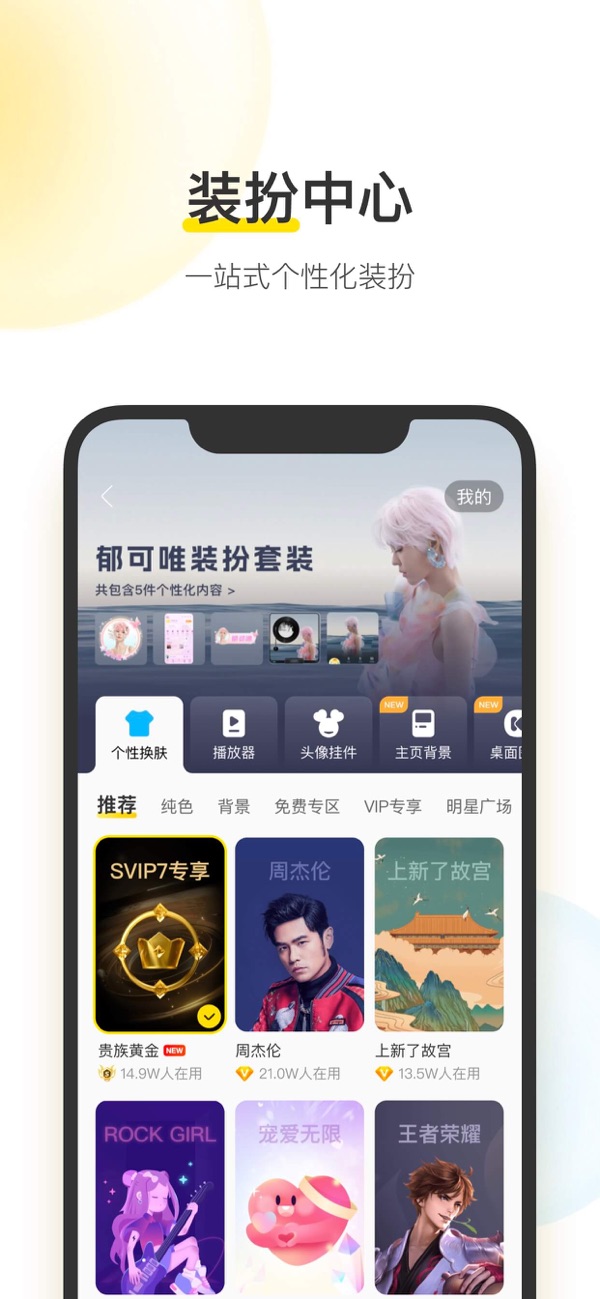

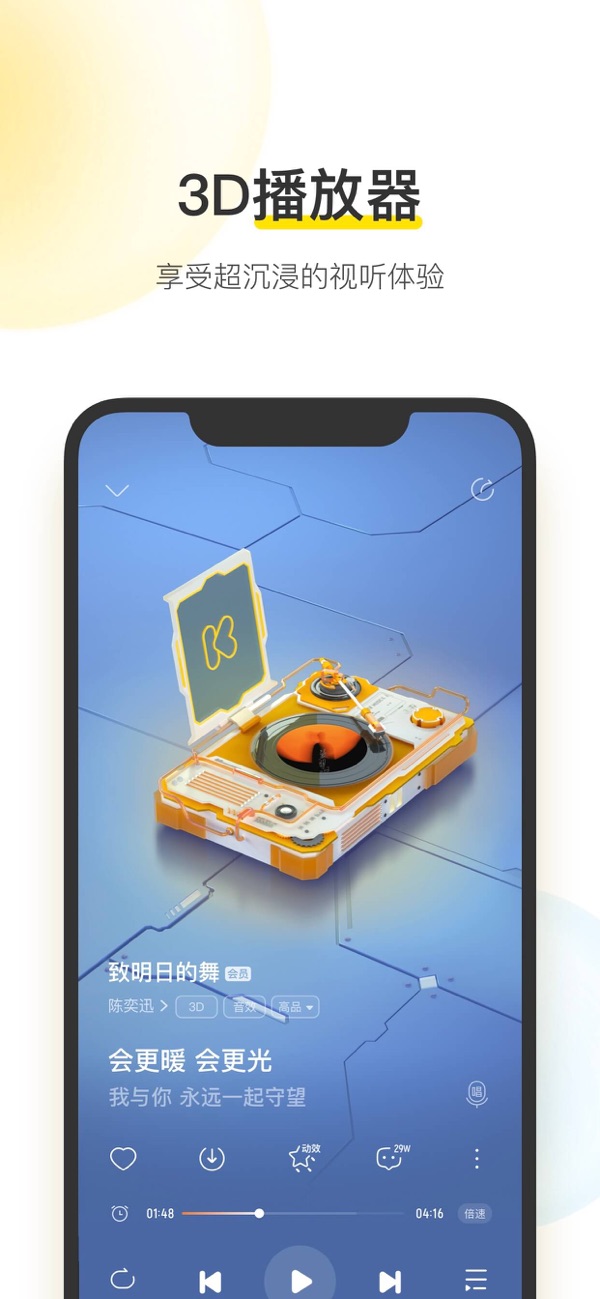

QQ Music is Tencent’s flagship streaming service, combining music with videos and gaming, being the go to place to “listen, watch, and play”.

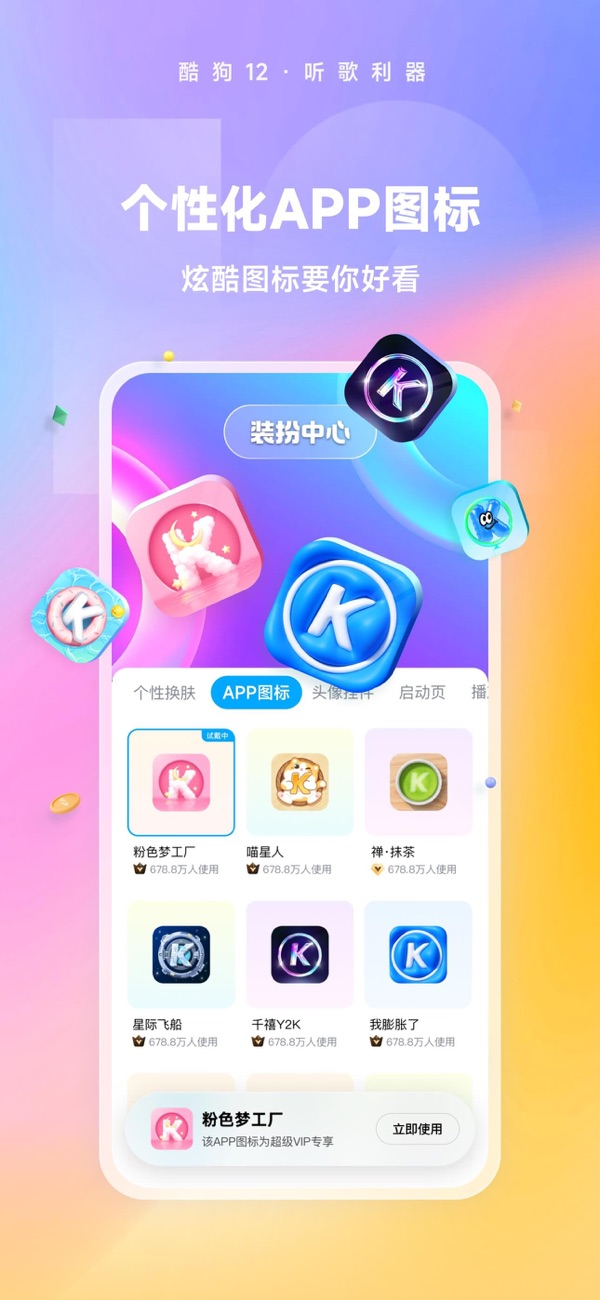

Kugou Music offers users more entertainment features, such as Kugou Live – a live streaming platform, with music performances, concerts and music variety shows.

Kuwo Music focuses “on exploring music’s companionship with people”. The streaming service offers functions for various scenarios, such as sleeping, driving, working and studying. Kuwo Music has partnerships with over 60 car companies, covering more than 80% of the car brands on the market. Kuwo also has vinyl music and 5.1 surround sound functions.

WeSing is the newest of the streaming services, with, as the name would suggest, “singing and socializing” as the priority.

QQ Music is a freemium music streaming service, with the basic features available for free and enhanced features available on subscription. Unlike other music streaming services, labels can restrict content to only subscribed users or only available for purchase. Artists using this strategy include certain albums from Noah Cyrus, Ariana Grande and Taylor Swift.

There are three subscription types on QQ Music:

- QQ Music Free

- Limited songs for streaming

- Limited songs for download

- 128kbps streaming

- No overseas listening

- No purchasable music

- No customization and themes

- QQ Music VIP

- All songs for streaming

- Up to 300 downloadable songs per month

- FLAC streaming and downloads

- Overseas listening available

- Purchasable music available

- Customization and themes

- Dolby Atmos support

- QQ Music Luxury

- All songs for streaming

- Up to 500 downloadable songs per month

- FLAC streaming and downloads

- Overseas listening available

- Purchasable music available

- Customization and luxury themes

- Dolby Atmos support

QQ Music connects to the Music app on iOS, which allows users to combine their Music library (usually Apple Music, iTunes and synced music) with their QQ Music Library.

What countries is Tencent Music available in?

Tencent Music’s streaming services are only available in China, however you can browse the site from anywhere in the world. This is useful for ensuring your music is live and checking up on your artist profile.

Artists

So you’ve got your music on Tencent’s music streaming services, what now? There are a number of steps you need to take before going any further.

How to customize your Tencent Music artist profile

Unfortunately, Tencent, nor any of the streaming services they operate, offer an artist portal like Spotify for Artists. Platforms like Spotify for Artists make customizing your artist page and viewing live statistics a breeze. Fortunately, for RouteNote artists, we can request changes to your artists profiles on Tencent’s stores. Simply send a link to your artist page on the stores, a short bio and image to support@routenote.com.

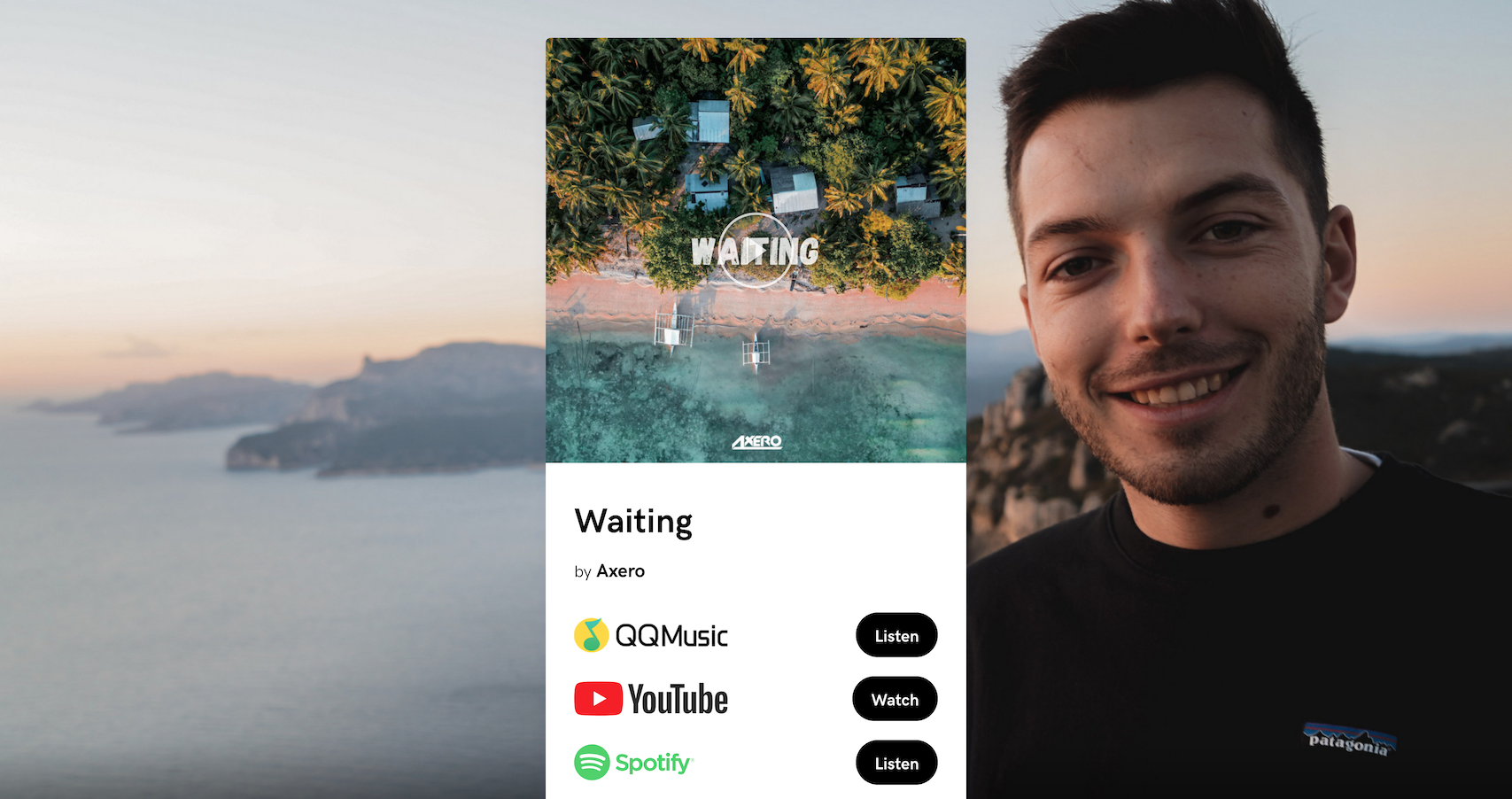

How to market your music with PUSH.fm

Congratulations, you’ve got your music on to all of the popular stores and your artist pages are looking perfect. Don’t expect the music streams to come flooding in. Marketing is a super important role for any independent artist. Luckily for you, our friends over at PUSH.fm have got the tools for you to promote your music for free! There are five key tools on PUSH.fm – Smart Links, Pre-saves, Reward Links, Pay Links and Competitions. We’ll be taking a look at Smart Links, as this one ties in nicely with Tencent Music.

Smart Links

Smart Links on PUSH.fm solves the problem of catering to a wide audience on various different platforms. There are a number of different templates you can choose from such as Bio Links and Fan Links (below). These Smart Links are fully customizable, allowing you to link to any site, change the main/background images and even add a custom URL.

Statistics

As an independent artist, it’s important to know where your fans are engaging with your content. PUSH.fm has detailed statistics that makes it easy to track how your audience are interacting with your campaigns, including visits, conversions, engagement, device types, sources and more, broken down by year, month, week, day or hour.