The potential new Democratic candidate for presidency, Kamala Harris, suggests that TikTok is going nowhere…

Category: Digital Video News

Alphabet just reported their second quarter 2024 earnings, including the revenue generated by YouTube ads…

After a long reign at the top of the short, vertical video game, competitor YouTube…

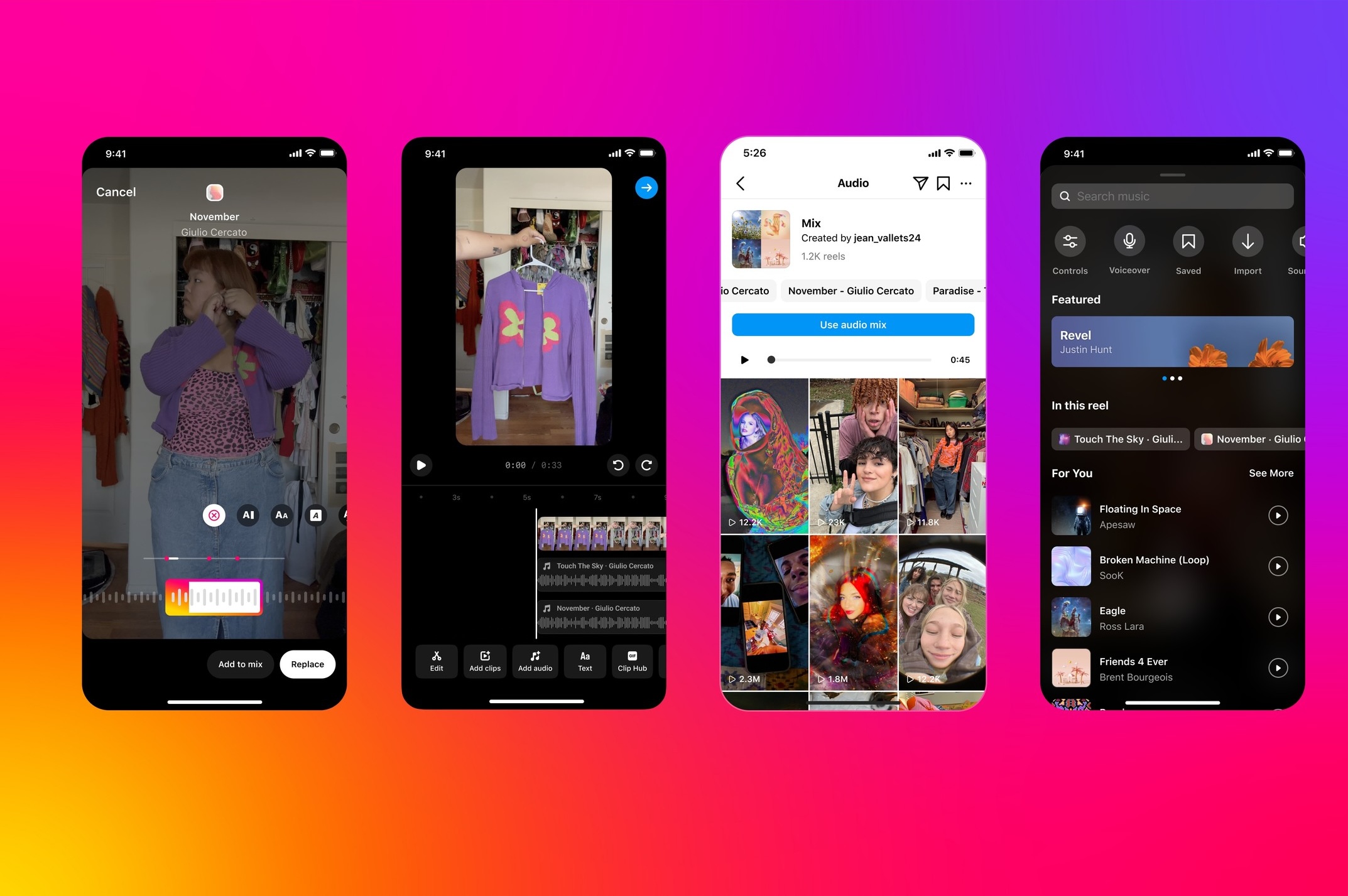

You can now include up to 20 audio tracks in a single Reel on Instagram,…

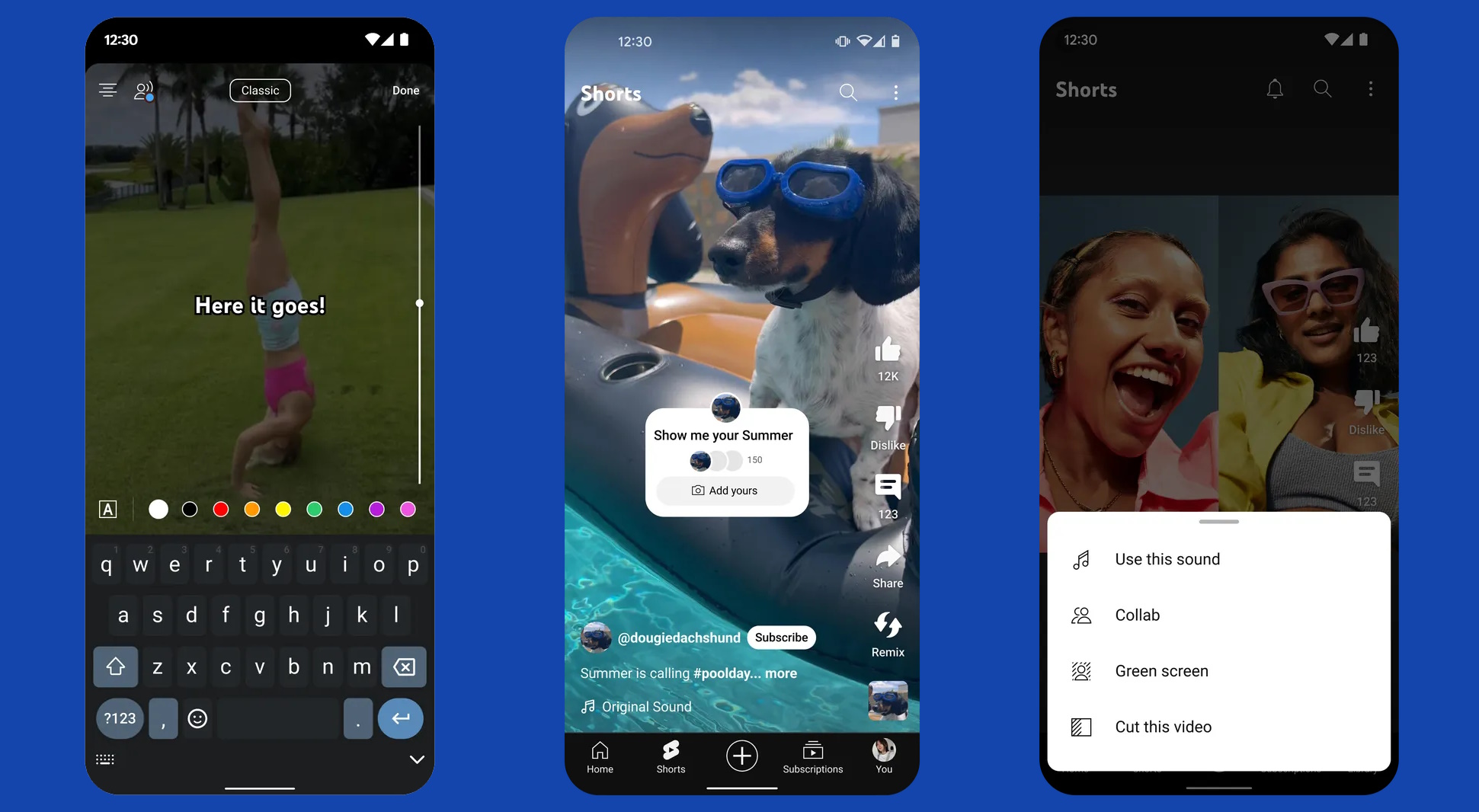

These six tools will make it easier than ever to create your very best Shorts…

We've rounded up the top 10 most-viewed videos on YouTube, as of July 2024. Warning,…

Copyright claims on videos won't necessarily mean that video is doomed to silence anymore with…

How much do a generation who have grown up with digital video platforms and easy…

Spotify may be the world's top music streaming platform but they're making serious waves in…

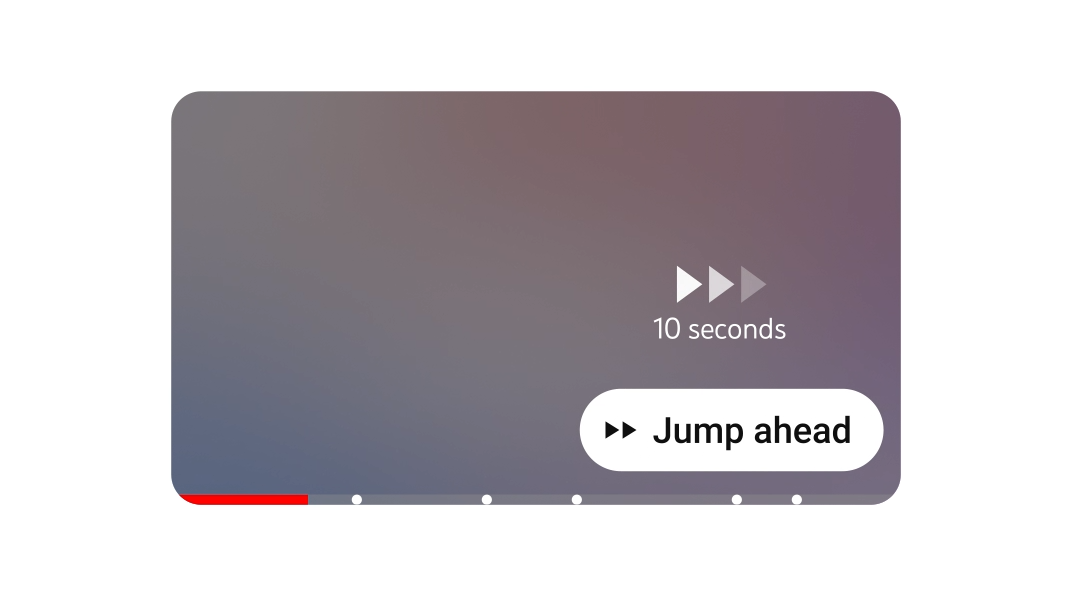

A bunch of new features are coming to YouTube to transform the way we watch…