Pandora’s grip on American music streaming to give way to Spotify in 2 years

Pandora have long been the favourites for online music in the US but eMarketer reckons their rein is coming to an end.

Spotify are easily one of the world’s leading music streaming services with hundreds of millions of users worldwide. Before they became so popular in the US, Pandora had the digital game down with their radio-style digital service offering up endless streams of music on-demand. Pandora are still winning the numbers game but for how long?

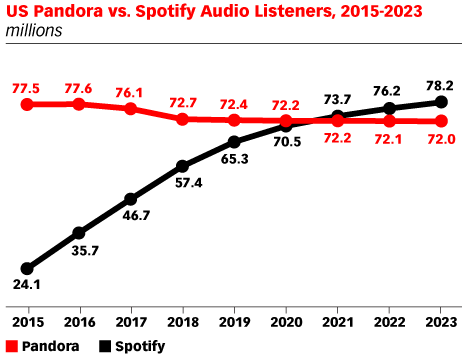

Online research firm eMarketer have predicted that Spotify will become the most popular music streaming service in the US by 2021, overtaking Pandora. They reckon that in the next 2 years Pandora’s userbase will slightly drop whilst Spotify continues its trend of meteoric growth worldwide in the US.

In their updated forecast for Spotify and Pandora, eMarketer predicts that Pandora’s user base will be 9% lower than their peak by 2023. Pandora currently have 72.4 million US listeners, 0.5% less than last year. Meanwhile Spotify have been growing nearly 14% year-on-year with 65.3 million users currently in the US.

eMarketer’s forecasting analyst, Chris Bendtsen said: “Pandora lost users last year because of tough competition from other services attracting people to switch. Apple Music has been successful in converting its iPhone user base, Amazon Music has grown with smart speaker adoption, and Spotify’s partnerships have expanded its presence across all devices.”

Whilst Pandora’s offering of unlimited music streaming was unique at the time it’s now the standard in music services. Bendtsen warns that the same is happening with Spotify and that their unique offerings which fuelled so much growth has now been diluted by competition.

Bendtsen says: “Spotify’s initial growth was driven by its unique combination of music discovery, playlists and on-demand features. But now that all music streaming services have the same features, Spotify’s future success will rely on partnerships with other companies. We expect more partnerships to come, leveraging multiple brands, devices and services to drive user growth.”

What Spotify still offers over most competitors, giving it the edge, is it’s free model. The same goes to Pandora. Whilst rivals like Apple Music are gaining large amounts of traction with subscription growth, growing 17% from last year in the US, it’s a subscription only service.