What is iHeartRadio and how to upload your music free

Although only available in a handful of countries, independent musicians and labels worldwide can upload their music to iHeartRadio for free!

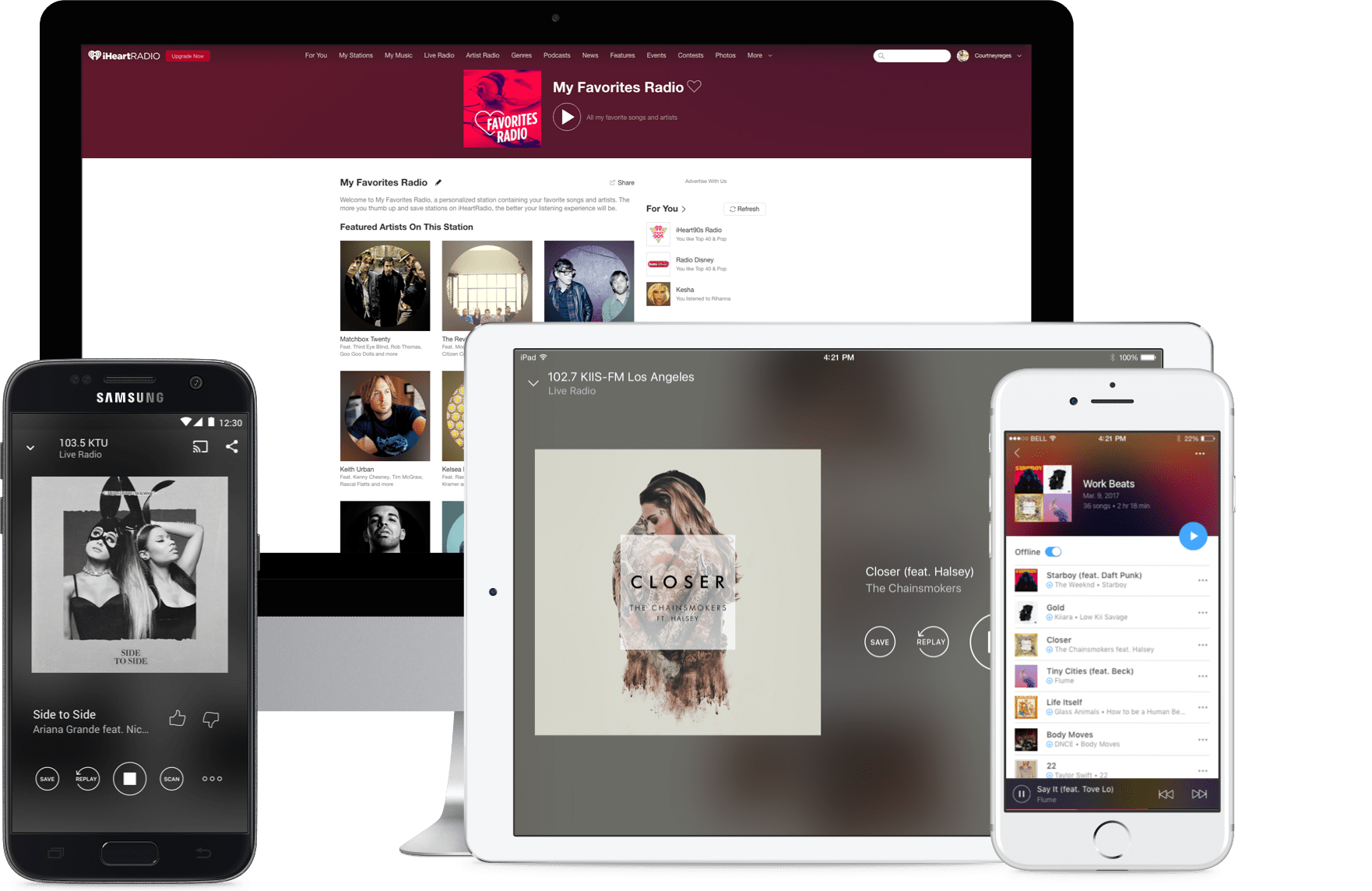

Broadcast, podcast and radio streaming platform iHeartRadio has come a long way since its introduction back in 2008. Owned by American mass media corporation iHeartMedia, iHeartRadio is a popular destination for listening to music, millions of podcasts and thousands of live and local radio stations, all available free of charge. Since the inclusion of on-demand music streaming in 2016, RouteNote artists around the world have benefited from distributing their music there.

Click below to jump to one of the following:

How to upload to iHeartRadio

For over 16 years now, RouteNote have helped over one million independent artists and labels get their music on stores, streaming services and social media platforms around the world. Why do so many users love RouteNote? Our combination of powerful tools and ease of use, at an unbeatable price has made RouteNote the leading digital music distributor in Europe.

To get started, simply:

- Sign up for a free RouteNote account

- Head to Distribution – Create New Release

- Follow the steps to input your metadata and upload your artwork/tracks

- In the Manage Stores page, choose your required stores and territories. Be sure to check the box next to iHeartRadio.

The final step you’ll be faced with before you send off your completed release, is Free or Premium distribution. RouteNote’s Free model has zero upfront of recurring fees, while you keep 85% of the revenue. RouteNote’s Premium model has a small upfront cost (depending on the release type), and a $9.99 annual fee.

Unlike other distributors, there are no other differences between our Free and Premium models. The features and stores available are exactly the same. Plus you can switch models for any release at any time. The artist always keeps 100% of the rights to their music.

For larger artists and labels, please get in touch with our team and ask about RouteNote All Access. This tier has additional features like tailored services, dedicated account management, priority support, pitching assistance, and early access to new features.

Once you’ve finalized your release, it will be sent to our moderation team. The moderation team checks every release for any formatting or copyright issues. We aim to get to every release within 72 hours, but this time frame can extend during busy periods. You’ll receive an email from us once your release has been approved or if there’s anything that requires your attention.

Once moderation has approved your release, it will be sent to our distribution team to send it to all of your chosen stores and territories.

Now that your music is on streaming services worldwide, it’s time to start reaping the rewards. For most stores, statistics and earnings are made into your RouteNote account 45 days after the close of each month. For iHeartRadio, earnings and statistics from on-demand streams are made into your account 75 days after the close of each month. This means that the streams you earn from iHeartRadio in January will be made into your account in April.

Earnings from radio plays are reported to SoundExchange. Find out how to collect your publishing royalties here.

What is iHeartRadio?

Starting as an online radio platform, transforming to a traditional music streaming service, facing tough competition, and everything in between. We explore how iHeartRadio started, where they are now, how to use the platform as a consumer, and more!

How did iHeartRadio start?

Founded in 2008 by Clear Channel, who rebranded to iHeartMedia in 2014, iHeartRadio launched in the US only, featuring news, music content, music videos and access to over 750 Clear Channel radio stations online. In its first year, iHeartRadio debuted on the just-launched iPhone App Store, giving users access to twelve radio stations in 8 markets. iHeartRadio launched on BlackBerry and Android the next year.

In 2011, iHeartRadio launched their free, all-in-one service, featuring thousands of live radio stations and custom artist stations. The following year, iHeartRadio launched “24/7 News”, online audio news, weather and traffic streams for several US cities.

Five years after its launch in the United States, iHeartRadio rolled out in New Zealand and Australia in 2013. This year also saw the service launch iHeartRadio Talk, a precursor to podcasts. iHeartRadio Talk featured original on-demand programming from celebrities and allowed users to upload their own content through podcasting platform Spreaker. iHeartRadio Talk was later rebranded to “Shows & Personalities”, then simply “Podcasts”. iHeartRadio continued to expand podcasts over the years, with acquisitions such as Voxnest.

In 2015, iHeartRadio Family was launched, bringing curated experiences targeting children, with a simplified interface and age-appropriate stations.

2016 saw iHeartRadio expand to Canada. This came alongside the launch of two subscription based on-demand services – “iHeartRadio Plus” and “iHeartRadio All Access powered by Napster”. This brought on-demand streaming to the music service for the first time, allowing paying subscribers to listen to exactly what they want, when they want. Introducing traditional music streaming services, alongside their existing radio offerings, with features like replay, search, skip, offline listening and curated playlists, allowed iHeartRadio to compete with other big players like Spotify and Apple Music.

As 2018 rolled around, iHeartRadio launched in Mexico. The most up-to-date number of monthly active users we have from iHeartRadio is in April 2019, when the company reported 275 million MAUs. In 2020, the service launched in Puerto Rico. This completed iHeartRadio’s current availability: United States, Canada, Mexico, Australia, New Zealand, and Puerto Rico.

Today, iHeartRadio is the largest radio broadcaster in the United States, at 5x the digital listening of the next largest commercial broadcast radio company. They compete closely with US broadcasters Audacy, TuneIn and SiriusXM. There are over 860 live broadcast stations in 160 markets across America. iHeartRadio is available on more than 250 platforms and 2,000 devices, including smart speakers, digital auto dashes, tablets, wearables, smartphones, virtual assistants, televisions and gaming consoles.

According to their website, iHeartRadio currently has 167 million registered users and 3.2 billion total downloads/updates!

Despite these impressive numbers, iHeartRadio is struggling to keep up with the market, as more users favor dedicated music streaming services like Spotify and Apple Music.

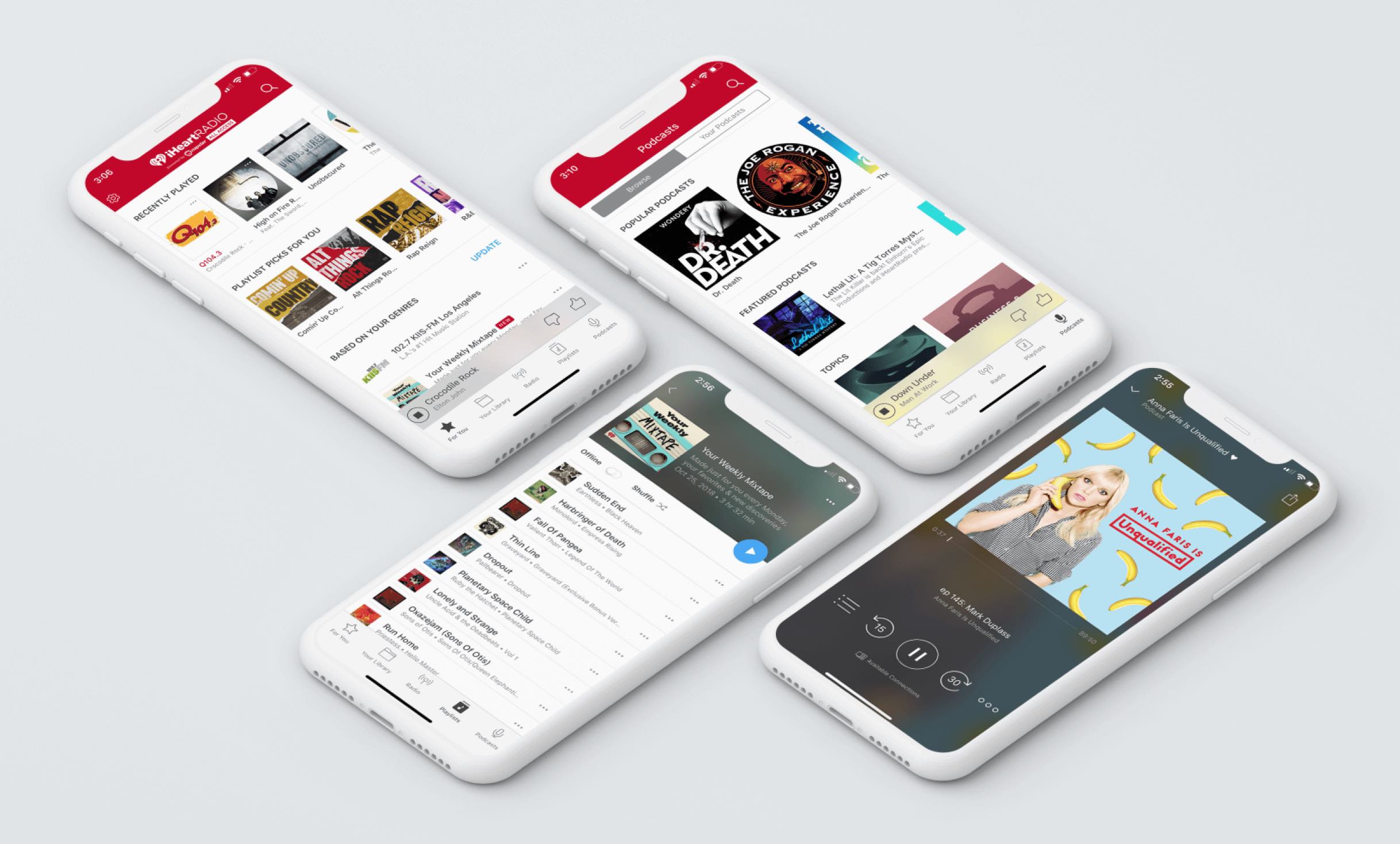

The basic features of iHeartRadio

If you’re in the United States, Canada, Mexico, Australia, New Zealand, or Puerto Rico and looking for a music streaming service with a heavy focus on radio, iHeartRadio might be the one for you. Radio spans news, music, sports, talk, comedy and more. Elsewhere on iHeartRadio, you can find personalized music stations, create your own playlists, browse thousands of hand-curated playlists (such as TikTok Trending on iHeartRadio), across moods, activities, decades and genres, and podcasts (such as iHeart 3D Audio).

iHeartRadio tailors its service using its music recommender system. Using the thumbs up/thumbs down rating tool will indicate to iHeartRadio the songs you do/don’t like. When listening to live stations, this information is fed back to the station. Using iHeartRadio Talkback, users can also send voice messages to shows and podcasts. When listening to customized stations, liking a song will have it and songs like it played more often. Disliking a song means that song will not be played again. Likes and saves are used to personalize users’ “My Favorites Radio” station, learning your tastes over time and adding various bonus tracks into the mix. Similar to Spotify’s “Discover Weekly” playlist, refreshed every Monday, “Your Weekly Mixtape” is the place to go to discover new music.

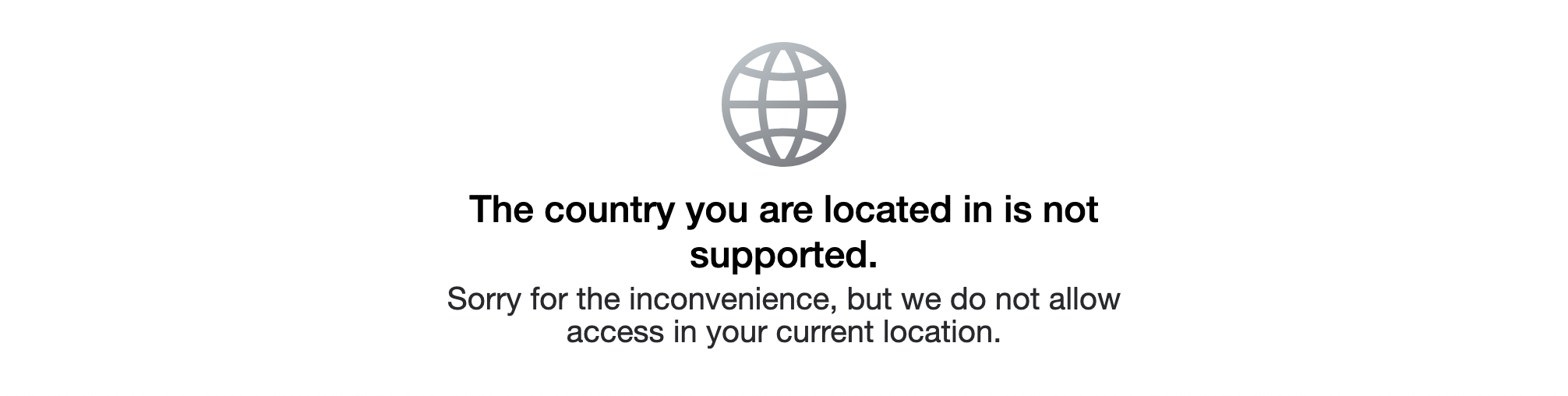

What countries is iHeartRadio available in?

United States, Canada, Mexico, Australia, New Zealand, and Puerto Rico. Attempting to access iHeartRadio outside of these regions will show the below screenshot. If you’re an artist, manager or label that needs to access the service from outside of these markets to ensure your music is live, you may need to use a VPN, but be sure to check iHeartRadio’s terms of service.

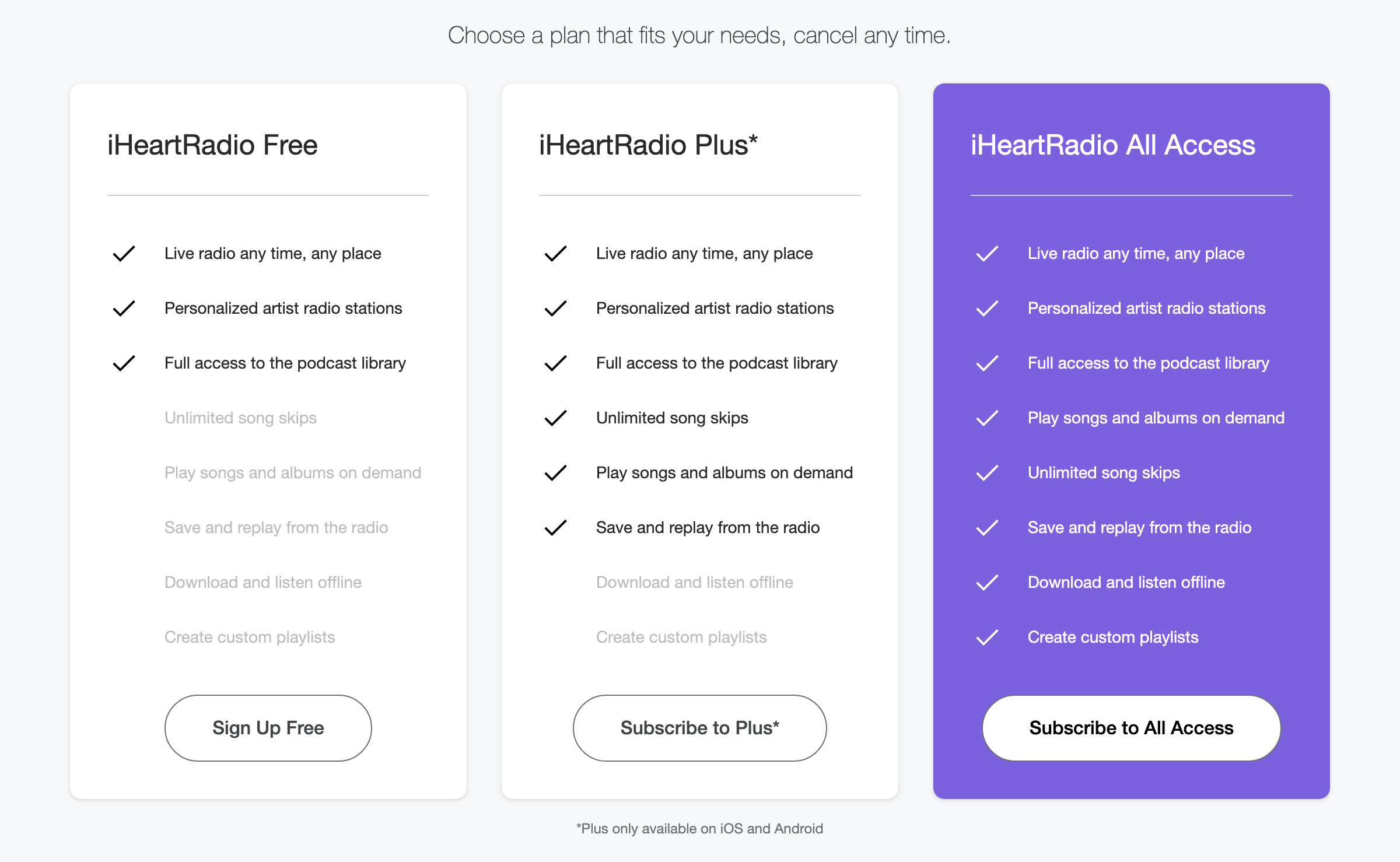

iHeartRadio subscription types

Subscribing to iHeartRadio Plus unlocks ad-free music, as well as access to unlimited skips and saving music from radio to playlists. iHeartRadio Plus is $4.99 per month on the web and $5.99 per month on the Apple App Store.

Subscribing to iHeartRadio All Access gets users access to all of the above, as well as full on-demand, unlimited access to all music, instant replay of songs from the radio, offline listening and the ability to create unlimited playlists. iHeartRadio All Access is only available for subscription through the iOS and Android app. It is $9.99 per month on the Google Play Store and $12.99 per month on the Apple App Store.

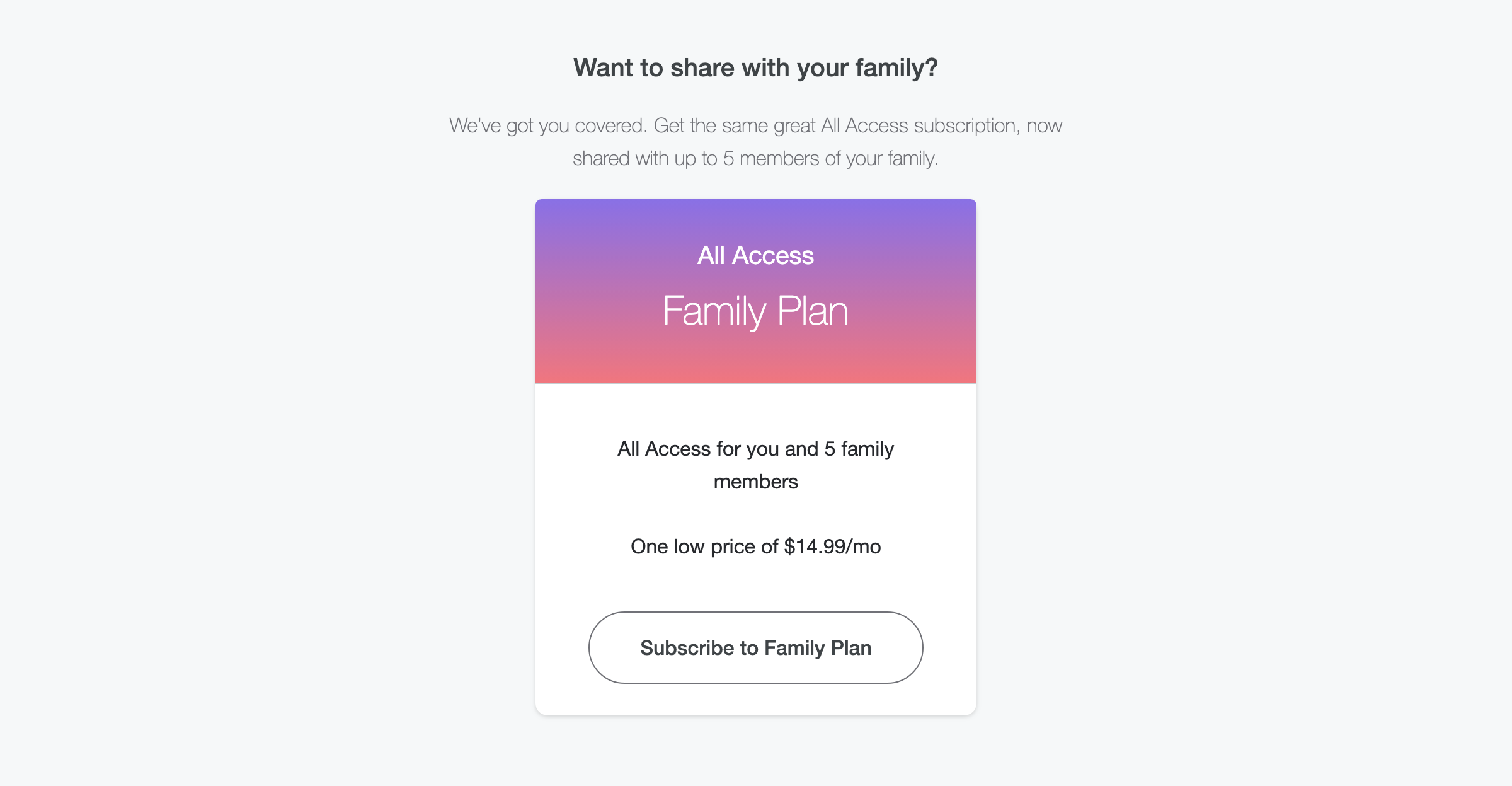

iHeartRadio Family Plan grants up to six family members their own All Access account. Family Plans are $14.99 per month.

All iHeartRadio tiers compared

That’s a lot of different tiers and prices depending on where you subscribe. Here are the above subscription types simplified, so you can find the best option for you. Remember, subscribe outside of the App Store to save on additional fees.

- iHeartRadio Plus: $4.99/month

- iHeartRadio All Access: $9.99/month

- iHeartRadio Family Plan: $14.99/month

How to stream iHeartRadio

iHeartRadio is available across more than 250 platforms and 2,000 devices. Below we have highlighted some of the most popular ways to access the music service.

- App Stores

- Amazon App Store

- Apple App Store

- Google Play Store

- Microsoft Windows App Store

- Samsung Galaxy Store

- Voice

- Alexa

- Google Assistant

- Samsung Bixby

- Siri

- SoundHound

- Travel

- Alaska Airlines

- Southwest

- Alexa for Hospitality

- Best Western

- Fairmont Hotels

- Hilton Hotels

- Hyatt Hotels & Resorts

- Legoland Resort

- The Peninsula Hotels

- St Regis Hotels

- Waldorf Astoria Hotels

- Home

- Web

- Epic Games

- Xbox

- Amazon Fire TV

- Android TV

- Apple TV

- Chromecast

- Comcast

- Direct TV

- Google TV

- LG

- Hisense

- Portal TV

- Roku

- Samsung

- TIVO

- Vizio TV

- Amazon Echo

- Google Nest

- Bose

- DTS Play-FI

- Linkplay

- Logitech

- Sonos

- Samsung Family Hub

- Automotive

- Alexa Automotive

- Android Auto

- Android Automotive OS

- Apple CarPlay

- Lyft

- Waze

- BMW

- Ford

- Lincoln

- General Motors

- Honda

- Jaguar/Land Rover

- Lucid

- Mercedes-Benz

- Polestar

- Subaru

- Volve

- Wearables

- Apple Watch

- Wear OS

How does iHeartRadio compare with the competition?

iHeartRadio’s heavy reliance on radio stations sets it apart from much of the music streaming competition. Adding traditional music streaming functionality in 2016 allowed the service to stay relevant. How does iHeartRadio stack up in 2024?

- Pros

- Free tier

- Affordable $4.99/month starting price

- Available on many devices

- Cons

- Limited availability

- Limited audio quality – 128kbps

Artists

Don’t expect to upload your music to streaming services and then the royalties to instantly start mounting. As an independent artist it’s your role to market and promote your music, in order to grow your audience.

How to customize your iHeartRadio artist profile

Unfortunately, iHeartRadio doesn’t have an artist portal like Spotify for Artists. However you can still customize your artist profile with an image and bio. Simply send the following to: content.music@xperi.com

- A link to your artist page on iHeartRadio

- A bio

- A .JPG or .JPEG image, 800x800px

Your profile image must be a photographic portrayal of the artist and be free of logos, borders, drawings, digital manipulation and effects, watermarks, and text.

How to market your music with PUSH.fm

Our friends over at PUSH.fm provide some great promotional tools to help independent artists market their music. Alongside Pre-saves, Reward Links, Pay Links and Competitions, Smart Links can help artists looking to promote their music specifically on iHeartRadio.

Smart Links

Smart Links are the best way to collate all of your relevant streaming links, from your music on iHeartRadio, to your music video on YouTube and everything else in between. Smart Links are fully customizable, allowing you to add links to anywhere, change the artwork, background and even the URL.

Statistics

Promotional tools are only half of the story at PUSH.fm. These tools are only helpful if you can see the results. Luckily PUSH.fm provides powerful statistics, so you can see exactly who is clicking on which links, broken down by year, month, week, day and time. For each campaign, you’ll find data such as visits, conversions, success rate, engagement, service providers, device type, traffic sources and more!