The global music industry just saw it’s biggest growth in 15 years

The recorded music industry around the world has seen a massive leap, aided by the new popularity of streaming services, with the biggest growth in over 15 years.

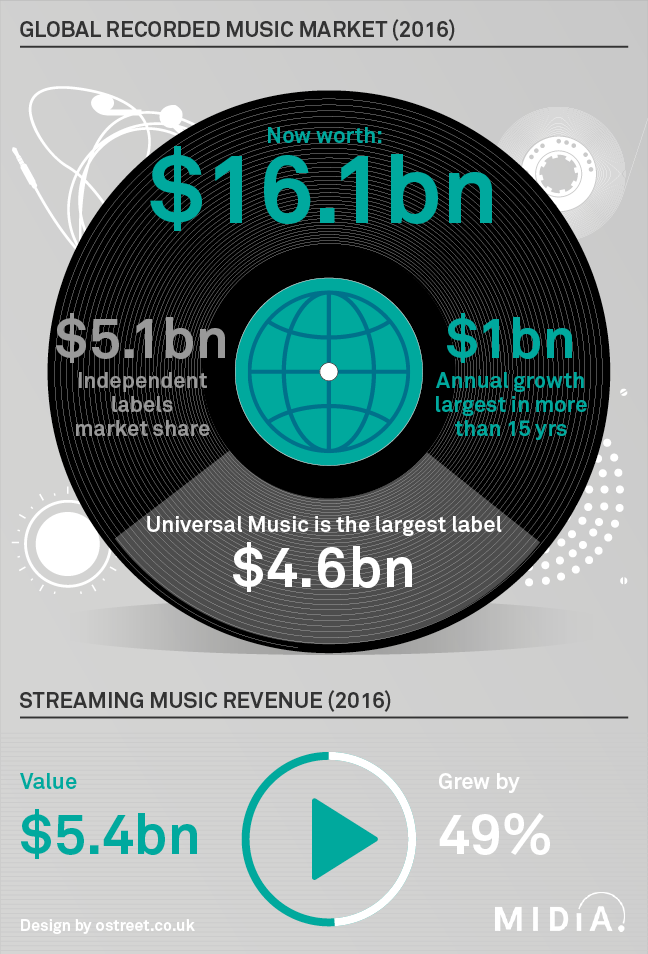

A new report from Midia Research shows that the global music industry grew by $1.1 billion in 2016 to a total net worth of $16.1 billion, a massive 7% rise on 2015. This is the largest overall growth for the worldwide music industry in over 15 years, after the Napster debacle caused music revenues to plummet.

This phenomenal increase has been boosted by the success of music streaming services which grew by 57% from 2015 to 2016. Spotify in particular stand out as the forerunners of the trend, laying claim to 43% of the 106.3 million music streaming subscribers that 2016 ended with. With 38.8 million subscribers added to streaming services last year this year should see an even heftier rise, signifying a positive future for the music industry.

In their report, Midia Research say: “Apple Music and Deezer also both contributed strongly to growth and market share. Additionally, Amazon upped its game in 2016 and the introduction of the $3.99 Amazon Prime Music Unlimited Echo bundle could open up swathes of new, more mainstream users. ”

Of course the vast majority of the impressive revenues went to the 3 major labels, which managed to earn collectively $11 billion of gross revenue just last year. Universal Music Group managed to dominate once again with 28.9% of the market under their brand and labels.

Independent labels and artists meanwhile generated an impressive $5 billion, however these numbers don’t include corrections for independent revenues that come under major labels for distribution. This will be acknowledged in a separate survey coming soon from WIN.

Midia Research gave a conclusion for the performance of the recorded music industry last year, which read:

The recorded music industry changed gear in 2016 and the outlook is positive also with revenue looks set to be on an upward trajectory over the next few years. However, successive quarterly growth is not guaranteed. Streaming will have to work extra hard to offset the impact of continued legacy format declines as the 18% download revenue decline in 2016 illustrates.

Thus, the midterm outlook is as much about legacy format transition as it is streaming growth. If streaming can outrun tumbling download and CD revenues as those walls come crashing down, then good times are indeed here.