Are Spotify losing ground to ‘social music’ platforms?

Image Credit: MIDiA

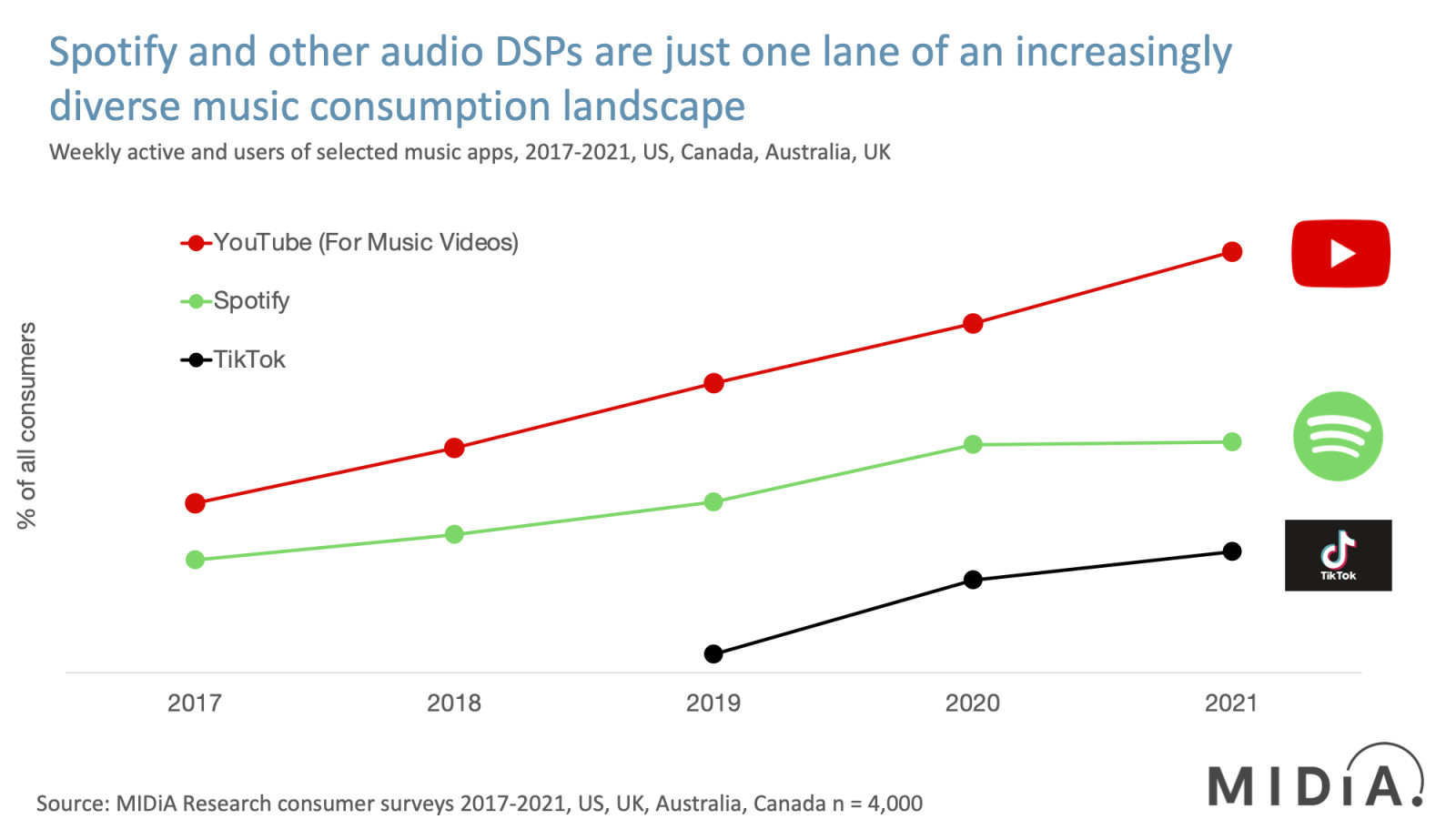

With growth struggling against social music competitors like TikTok, how can Spotify ensure their goal of owning the audio market?

Media and technology analysis company MIDiA recently published a blog post titled: Can Spotify break out of its lane? The piece explains how DSPs or streaming services such as Spotify, Apple Music and Amazon Music may struggle to hold their ground against what Mark Mulligan calls the “social music revolution”.

After several years of relative stability, music consumption is shifting. While major labels saw streaming revenue growth of 33% in Q2 2021, Spotify was up just 23%. Mulligan points out that it’s unwise to read long-term market trends into one quarter’s worth of results, however signs were previously showing that we are entering a genuine market shift. Mulligan asks “whether Spotify and the other Western DSPs are going to find themselves left behind by a fast-changing market, or can they innovate to keep up the pace?”

Take a look at video streaming platforms. Netflix for example added just 1.5 million subscribers in Q2 2021, against YouTube, which grew by a massive 84%.

Social media is streaming’s new growth driver, generating around $1.5 billion in 2020 and growing fast in 2021. The post goes on to explain how this is a natural evolution of social media rather than an evolution of streaming. “Audio is just another tool for social expression, along with video, pictures and words. MIDiA has long argued that Western streaming focuses too heavily on monetizing consumption, at the expense of fandom. While social video does not fix the fandom problem, it does cater to some of the key elements of fandom: self-expression, identity and community.” In neglecting fandom, traditional streaming services have created a vacuum that TikTok and Instagram eagerly filled.

The report goes on to explain how DSPs are here to stay for the foreseeable future and will continue to be the biggest source of revenue, but they will likely only make up a portion of the music landscape, rather than dominating online audio completely. Mulligan says there’s no clear way for them to break out of their path, but we will likely see these services build more social communities and video into their apps as a way to compete.

MIDiA points to Facebook’s approach to owning ‘socials’. By creating/buying multiple apps, such as Instagram, WhatsApp and Messenger, Facebook didn’t become the next MySpace or Yahoo. Spotify on the other hand are currently trying to compete with themselves, rather than branching out, with additional apps such as podcasts and audiobooks. This would also make the attractiveness of a podcast or audiobook subscription more attractive to users.

Click here for the full blog post from Mark Mulligan on MIDiA.