How COVID has affected the music industry

Following a streaming boom that brought the music industry back to growth for the first time in decades, the global pandemic has caused huge setbacks for many artists.

The last year has been difficult for everyone. No matter where or what industry people are in, the pandemic has had huge effects on the world. For us, the effect on the music industry has been impossible to ignore.

On the one hand, streams of music have risen with so many people spending more time at home and with less to do. We’ve even seen creativity flourish, with home creators like bedroom producers and garage bands having more time on their hands to write and record their masterpieces than ever.

On the other hand, the live industry has been decimated and – in the new streaming economy we live in – that has had a devastating effect. Gigs, festivals, and tours around the world have been put on hold and we can’t escape the impact that has had on many artists.

Whilst some artists may have thrived from the growth of streams, there is a significant section of the music industry who have suffered. That’s what we’re going to look at today: how has the COVID-19 pandemic impacted artists, labels and others in the music industry in the last year and a half.

What impact has COVID had on the music industry?

Immediately before the pandemic hit and transformed the world, music was seeing a powerful resurgence after decades of decline. Following the horrendous effects of music piracy on global music revenues, streaming services stepped in to save the day and the past few years have seen global revenues climb for the first time in years.

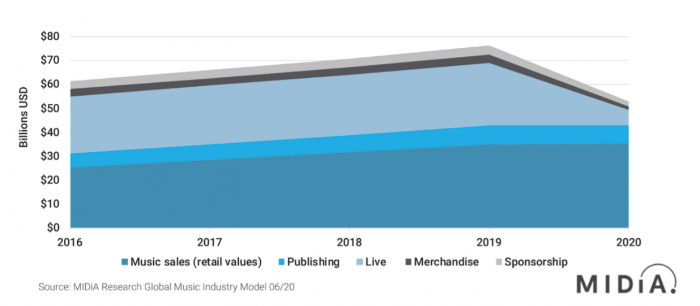

The recorded music sector returned to growth in 2016 and and right up until 2020 was continuing to rise, growing an average of $4.5 billion each year between 2016 and 2019. Now MIDiA are predicting a 30% decline in revenue for 2020, the year the pandemic hit.

Whilst music streaming continued to thrive, growing to $10 billion in the U.S. last year, it was the effect on the rest of the industry that sadly saw the figures fall in a net decline. The live industry understandably plummeted and merchandise and sponsorships also saw a decline that couldn’t be offset by continued growth in music streaming revenues.

Live music fell by a whopping 75% in 2020 with predictions saying that the gig economy won’t return until 2022 at the earliest. The usually symbiotic relationship of the music industry that has seen incredible growth in recent years has been hurt by this decline and that’s brought even more attention to streaming.

Streaming and live: Best friends separated

Whilst streaming has in many ways saved an industry on the brink, it’s not without its critics. There has been much discussion about whether the low per-play payouts are really fair to an artist, working on something like a performance royalty type rate as if songs were being played on the radio – though in reality they are listened to with on-demand access more closely related to digital downloads.

There is no debate that streaming a track earns less than purchasing a track. What streaming has managed to do is monetise the ubiquitous access to music that piracy offered listeners. That global access to music also provides a great boost to artists in many other ways.

Live music and streaming are considered to go hand in hand these days. Thanks to streaming, the discovery of an artist isn’t locked behind a $14 paywall (or however much CDs cost where you’re from); any listener can take the risk of listening to a new artist and potentially discovering a brand new favourite. Music discovery is the unofficial tagline of the streaming age: streaming accounting for 52% of new music discovery.

That discovery has many positive knock-on effects. Once an artist has been discovered they have a new fan who might like them enough to go the next step and buy their music once they know they enjoy it enough to keep. Hence why vinyl sales have surged back up in recent years alongside streaming, as listeners look to cherish the music they love in a more special way – even whilst it’s all available at their fingertips.

A bigger fanbase also leads to more dedicated listeners, which sells merchandise where huge money can be earned from artists. T-shirts, pencil cases, badges, and basically anything that can have a band logo added to it offers artists a huge potential profit margin – not to mention free advertising.

Then there is the biggest through-sale for artists from streaming: concerts. Streaming builds up loyal fan bases and dedicated listeners leading to increased ticket sales and nowadays gigging often makes up the majority of an artist’s earnings. However, without the live industry’s earnings last year, artists have looked towards streaming as a primary source of earnings and the much-debated royalty rates have come into question more than before.

This can be clearly seen by the fact that the UK government has had its largest inquiry into the streaming economy in the last year. This has been further compounded by the #brokenrecord trending discussion that has taken place whilst so many were at home and able to rally behind a cause.

Whilst there are many artists making a living from streaming, there are many more who relied on the cohesive ecosystem that streaming had given birth to. With the return of live music we’ll hopefully see artists escaping the struggles of the last year again, but the conversations that a streaming industry without its profitable counterparts has given rise to won’t be forgotten.

The future of music streaming after COVID

Music streaming royalty rates have been discussed a lot in recent years and the results often seem to be that a majority are in favour of an increase. The question of raising royalty payouts isn’t simple though.

Streaming services risk losing customers with price increases and fierce competition in their space means that the first to raise subscription prices will be facing cheaper opponents. Unfortunately, inflation means that a $9.99 subscription is worth 28% less in 2020 than it is 2008 (when Spotify had just launched). Change needs to be made, but services with a large company behind them like Apple Music and Amazon Music are unfortunately in a better position to increase payouts without raising prices to standalone services like Spotify and Deezer.

With the return of live music – though with many special measures still in place – the gig economy is coming back to the relief of many artists. This will allow streaming and live’s partnership in discovery and ticket sales to return, particularly as streaming has grown even further during the pandemic.

In fact, predictions for the future of music streaming are looking very bright. Analysts predict that there will be 697 million streaming subscribers by 2027, almost double the 362 million recorded in 2019. That figure doesn’t include the number of freemium listeners using music streaming services.

This will be driven largely by growth in emerging markets like China and India, which are predicted to account for 44% of subscribers by 2027. Streaming services are looking to these emerging markets for the future as uptake in listeners has begun to flatten in Western countries like the US and European territories. Most listeners likely to subscribe to digital services for music in these markets will already be using streaming services.

With a huge population and a streaming market that is only just beginning to blossom, these Asian markets represent a huge potential for growth. However, Western markets are currently worth more per user due to higher average revenues. Western markets will make up 76% of $45.5 billion streaming revenue in 2021, analysts say.

The future of music streaming is clearly in broadening the userbase across the entire world but more will need to be done as we progress in how much users are paying for these services and how much artists are receiving from them. The conversations are in motion and the pandemic has made the voices involved louder than ever. We now just wait with keen attention to see how the industry reacts.