SoundCloud’s 2019 revenue was up 37% year-on-year, with Q3 2020 as their first profitable quarter

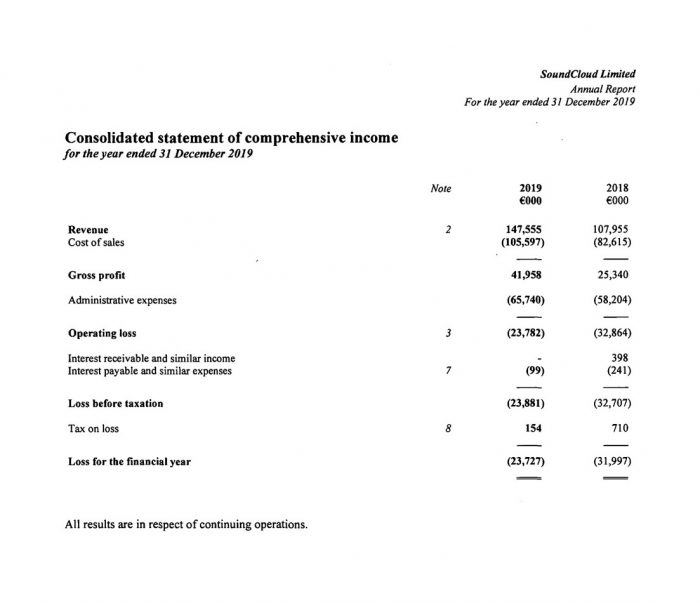

A recent annual report on Companies House shows SoundCloud took €147.6m ($165.7m) in revenues in 2019, as well as a very impressive Q3 2020.

The streaming platform reported its first ever profitable quarter in Q3 2020 on an EBITDA basis.

SoundCloud’s revenue is accelerating, in 2018 reporting a year-over-year increase of 19%. In 2019, SoundCloud reported Q1 revenue increase of 17% YoY and 43% YoY increase by Q4 2019. The company’s annual operating losses narrowed, from €32.9m ($39.2m) in 2018, down 28% to €23.8m ($26.7m) in 2019.

SoundCloud boast the most tracks available for streaming on their platform, recently reporting over 250 million tracks. This is miles ahead of platforms such as Apple Music with around 70 million songs for streaming. As of November 2020, SoundCloud announced 12 million creators are heard every month.

According to their annual report, SoundCloud set many new all-time highs in 2019, such as Monthly Active Users, Daily Active Users, Listening Time, Subscribers and Advertising.

SoundCloud believe they offer the complete package for both creators and consumers, stating in the report: “The SoundCloud platform is more than a traditional one-way retail streaming service and more than a simple two-sided marketplace, it is an accelerator for global audio culture – we connect creators, fans and the industry to what’s next in music, in real-time.”

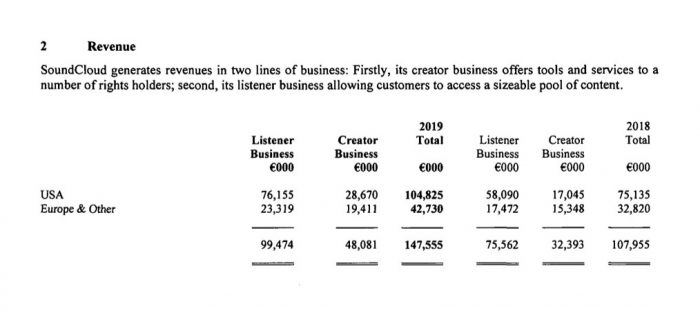

SoundCloud’s revenue is split into two areas. Listener Business covers advertising and subscription revenue from consumers, while Creator Business covers money from creator tools such as SoundCloud Pro Unlimited and SoundCloud Repost. SoundCloud acquired Repost Network, their distribution and marketing tool for indie artists, in June for approximately $15m according to a spokesperson. Creator Business also covers integration with DJ software such as Serato, Virtual DJ, Dex 3, Native Instruments, Pioneer and more. SoundCloud say this makes them “the most widely integrated streaming service in DJ performance software and hardware.”

Listener Business generated 67% of 2019’s revenue at €99.5m ($111.7m), with Creator Business at 33% or €48.1m ($54.0m). Creator Business is growing faster than Listener Business, with these percentages sitting at 70% and 30% respectively in 2018.

The report shows SoundCloud had €39.9m ($45m) in cash on its books by the end of 2019, plus $75m from investor SiriusXM. SoundCloud implemented a US ad sales relationship with Pandora (owned by SiriusXM). In 2019, the SoundCloud formed more ad sales relationships with new partners such as Targetspot (France, Germany, the Netherlands, Belgium, Portugal, Switzerland, Italy, Spain and Austria), Global Radio Services (United Kingdom), DAX (Canada) and Southern Cross Austereo (Australia).

The report also references COVID-19’s potential affect on SoundCloud:

While it is too early to predict the impacts on the financial year 2020, we have seen a true mix of tailwinds and headwinds – with strong growth in our creator products and our subscription business lines, along with weakness in our US advertising business which we expect to recover in step with the broader market.

SoundCloud Limited – Annual Report: Companies House

With multiple years of consistent growth, and the additional capital raised earlier this year, SoundCloud is well-positioned to weather the anticipated impact to the business and continue a sustainable growth path in 2020.