How many music streaming subscribers are there in 2022? MIDiA’s latest report compares all services

While Spotify still remain king in 2022, strong growth from Chinese DSPs helps Tencent Music steal third place from Amazon Music Unlimited.

MIDiA just published their annual music subscriber market share report, analysing 23 music streaming services across 33 markets, as of the end of Q2 2022. You can puchase the full report here or view the highlights in Mark Mulligan’s blog post.

Nearly all leading DSPs saw strong subscriber growth in 2021 and the first half of 2022, especially Chinese stores Tencent Music Entertainment and NetEase Cloud Music. While subscriber growth was stronger in the full year 2021, than 2020, MIDiA reports slower growth from H1 2021 to H1 2022, as streaming matures in Western markets.

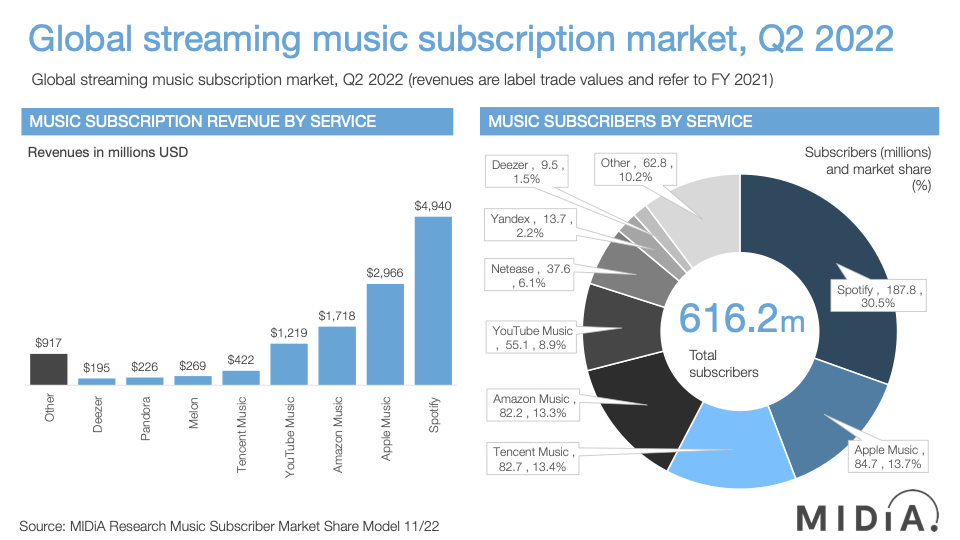

By the mid-point of 2022, there were an estimated 616.2 million subscribers across all services. This is up 7.1% from the end of 2021, with an additional 42.1 million net subscribers. This figure is slightly down from the 53.8 million net subscribers added in the six months following the start of 2021.

These paying users brought in $12.9 billion of subscription label trade revenue in 2021, up 23.1% on 2020. This marks the first year revenue growth has exceeded subscriber growth, as global annual ARPU (Average Revenue Per User) increases by 1.0% to $22.42.

Unsurprisingly, Spotify still remains by far top of the list, with 187.8 million subscribers in Q2 2022. Despite this lead, thanks to growing competition, their market share has steadily decreased from 33.2% in Q2 2018, down to 30.5% in Q2 2022.

This growing competition comes particularly from leading Chinese stores (where Spotify does not operate) Tencent Music Entertainment and NetEase Cloud Music. In Q4 2021, TME overtook the third largest global DSP Amazon Music Unlimited. As of Q2 2022, MIDiA reports TME holds 82.7 million subscribers and around 13.4% market share. Today, China is the world’s second largest subscriber market, on track to surpass the US.

Apple Music, Amazon Music Unlimited and YouTube Music all hold the second, fourth and fifth places respectively. As of Q2 2022, Amazon Music Unlimited has 82.2 million subscribers, while YouTube Music comes in at 55.1 million, with both services seeing shares increase between Q2 2021 and Q2 2022. These two services are currently growing faster than the total market, but at a declining rate. Apple Music continue to underperform. While 84.7 million subscribers places them in second place, their 13.8% market share is down 1.2% from Q2 2021.

In a blog post, MIDiA’s Mark Mulligan closes with the following.

The global music subscriber market is approaching a pivot point, with the slowdown in mature, Western markets contrasting with more dynamic growth in other regions. It is realistic to assume that the global recession and the organic maturation of the global subscriber market will result in some slowdown of growth in 2023, even if the sector remains otherwise resilient.

The slowing growth should be the catalyst for what needs to come next, especially in developed markets: unlocking growth pockets through differentiation. Western DSPs have managed to grow with largely undifferentiated product propositions. Music rightsholders should explore creative ways in which they can empower their DSP partners with differentiated content assets, enabling them to super-serve specific consumer segments and thus unlock extra growth within them

Mark Mulligan, MIDiA

Good news for all independent artists, RouteNote distribute to all of the stores mentioned above for free. Click to learn how to upload your own music to Spotify, Apple Music, Tencent Music Entertainment, Amazon Music, YouTube Music, NetEase Cloud Music and many more.