Mobile music set to explode with 950 million users by 2022

A new report reveals the success of music streaming and downloads on mobile devices and predicts massive growth looking towards the future.

The Global Mobile Music Forecast by Strategy Analytics reveals an exciting future for music on mobile. It predicts that by 2022 there will be 950 million users downloading or streaming music on their mobiles, double the mobile music users in 2015.

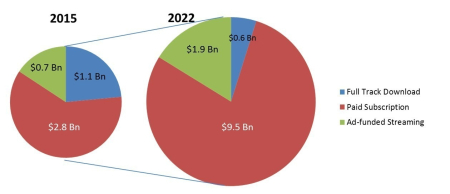

The report also says that by 2022 music streaming will make up 95% of mobile music’s $12 billion value, over double it’s current worldwide revenue of $4.7 billion in 2015. The boost to music on mobile will expand as broadband becomes more universally available and roaming data costs continue to drop.

Strategy Analysis’s director of wireless media strategies, Nitesh Patel said:

Streaming music services are proving a better fit for mobile music than music download stores. On the demand-side the growth in mobile streaming is being driven by increasing consumer demand for anywhere and anytime access to tens of millions of tracks via streaming music services, like Apple Music, Google Play Music, Spotify, and YouTube, instead of downloading or side-loading.

On the supply-side higher smartphone penetration, as well as competitive data plans offered by operators, including zero-rated and unlimited data plans, are removing consumers’ concern for data coverage when listening to music on the move.

The forecast’s author and analyst of Wireless Media Strategies, Wei Shi spoke interestingly on the adoption of streaming in some countries, saying: “Important markets like Japan, which transitioned late from consumption of physical music to digital music, have largely bypassed download and gone directly to streaming. We have seen competition between services driving prices downwards.”

Curiously the report shows that whilst in many parts of Western Europe and North America ad-supported free music streaming pales in comparison to premium revenues, places in Eastern Europe and Latin America are seeing similar income from advertising as they are subscriptions. As streaming services come under fire for low payouts on free streaming tiers hopefully an equilibrium can found like in Eastern Europe and Latin America.