Spotify reports record Q2 2024 profits, misses monthly user targets

Image Credit: Spotify

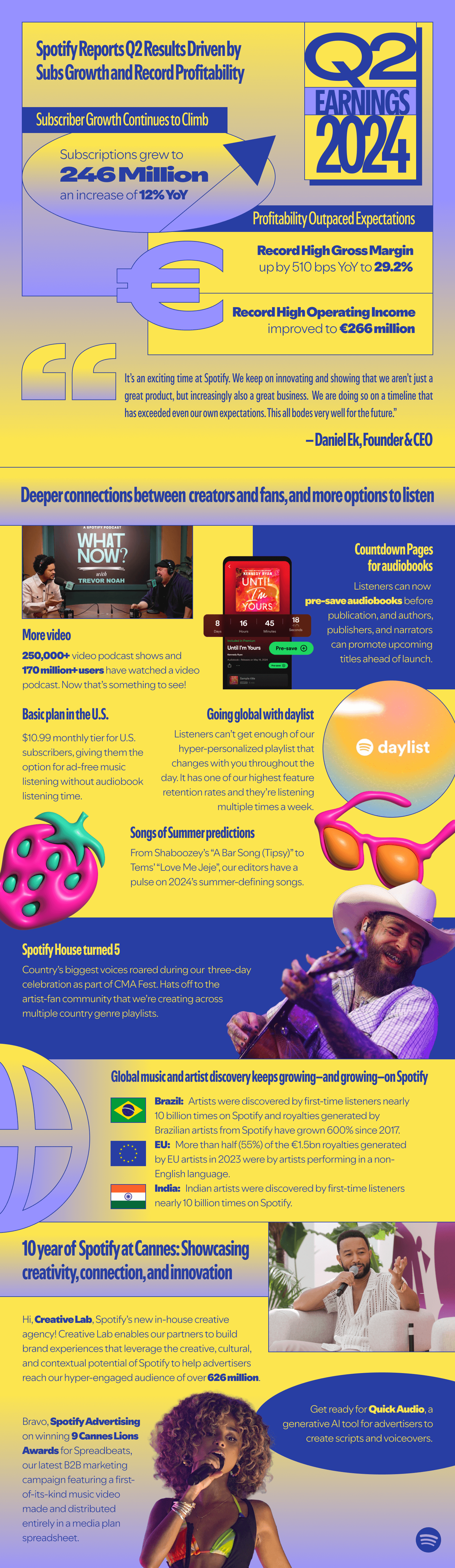

Spotify has revealed a record operating profit of €266 million after announcing its financial results for the second quarter of 2024.

This quarter marks a significant turnaround for Spotify compared to the same period last year when the company reported an operating loss of €247 million.

However, despite its financial success this quarter, Spotify has fallen short of its growth projections for monthly active users (MAUs).

The streaming giant closed out June 2024 with 626 million MAUs, reflecting a 14% increase year-on-year. While impressive, its growth is 5 million users shy of the 631 million that Spotify had previously forecasted.

In contrast, the company exceeded its expectations for premium subscribers at 246 million – 1 million above its guidance, representing a 12% increase from the previous year.

Revenue for Q2 2024 was robust, rising 20% year-on-year to $4.13 billion and aligning with Spotify’s predictions. Meanwhile, Spotify’s operating profit of €288 million surpassed the company’s forecast of $250 million.

Spotify’s Q2 shareholder deck noted, “Although we did see another quarter of MAU variability, funnel conversion remained strong, particularly in developed markets where we recently adjusted pricing.” The company attributed part of its improved profitability to better returns from music and podcast streams, as well as strategic pricing adjustments in key markets.

While Spotify’s financial health appears robust, it continues to navigate challenges related to publishing royalties. For example, the National Music Publishers’ Association (NMPA) in the US has criticized Spotify for reclassifying its premium tier as a ‘bundle’, a move that results in lower mechanical royalties.

Geographically, Spotify’s user base showed notable trends. The ‘Rest of World’ segment, which includes markets outside Europe, North America, and Latin America, has become increasingly significant.

This segment accounted for 33% of Spotify’s MAUs in Q2 2024, up from 30% the previous year and 24% in Q2 2022. Latin America’s share also increased slightly, from 21% to 22%. Conversely, North America and Europe saw declines in their shares of total MAUs, down to 18% and 28% respectively. Despite these declines, all regions experienced net user growth.

The North American market, in particular, presents a mixed picture for Spotify. Over the past year, the company added only 2.5 million MAUs in this region, suggesting a potential saturation or intensifying competition in the streaming space.

Looking ahead, Spotify’s guidance for Q3 2024 anticipates continued growth. The company projects an addition of approximately 13 million MAUs, bringing the total to 639 million, and an increase of 5 million premium subscribers, reaching a total of 251 million. Revenue is expected to hit €4 billion, with an operating profit forecasted at €405 million.