Ad-supported video streaming on the rise: What could this mean for the music industry?

Image credit: Jakub Żerdzicki

Ad-supported video streaming subscriptions are booming, could music streaming see a similar shift? Here’s how it might affect artists and their revenue.

Ad-supported video streaming: A growing trend

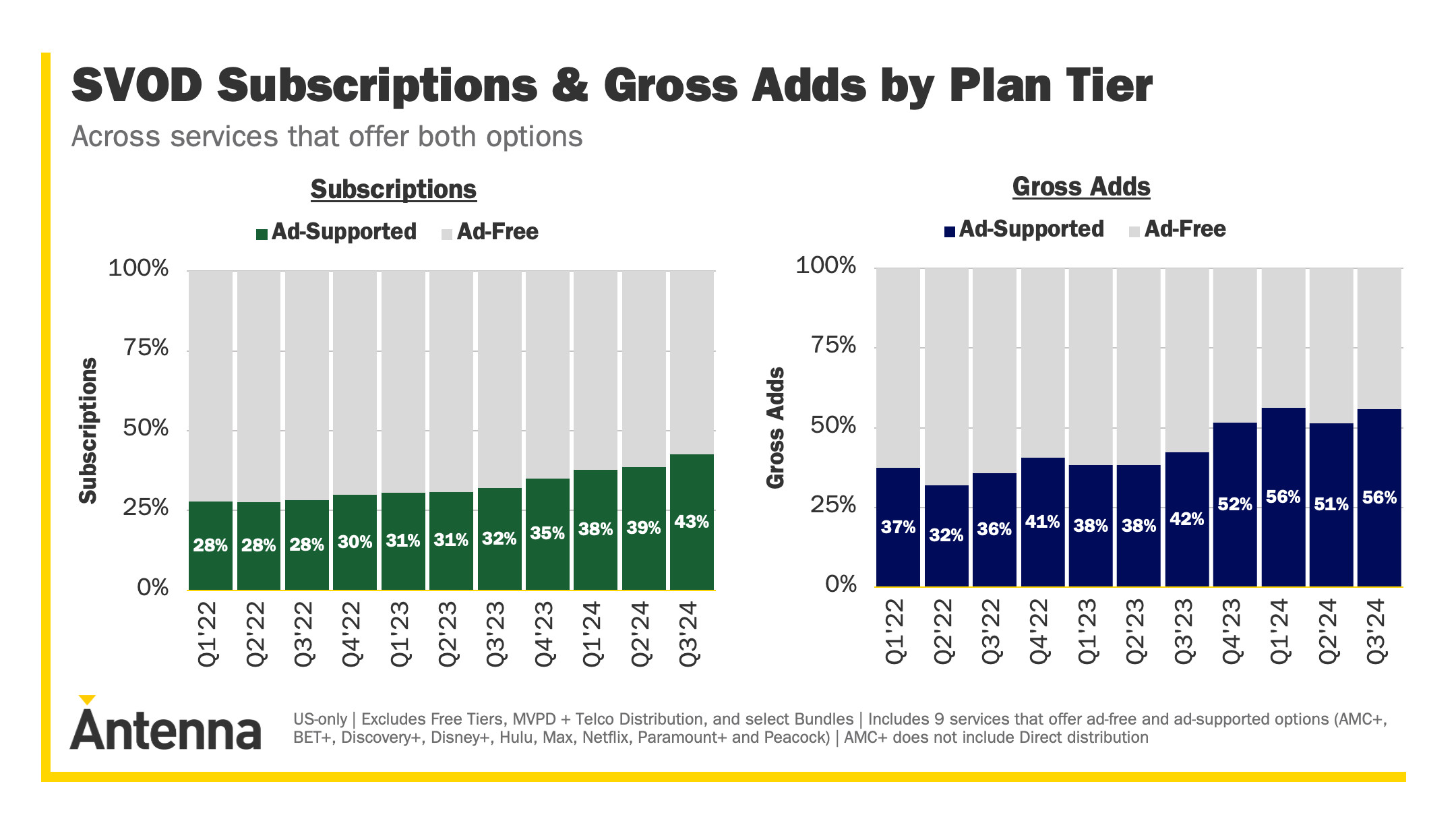

Ad-supported video-on-demand (VOD) streaming has continued to surge in 2024. According to Antenna’s Q3 report, 43% of all subscriptions to services offering ad-free tiers were ad-supported in the US. The growth is significant as ad-supported tiers grew by nearly 50%, while ad-free subscriptions dropped by 5%.

Netflix’s ad-supported subscriptions accounted for 44% of new subscribers since Q3 in 2023, with this figure remaining high for both HBO Max (39%) and Disney+ (62%). Across the board, ad-supported VOD subscribers increased by 11% over the past year and 15% since 2022. Between Q2 and Q3 in 2024 alone, the proportion of ad-supported subscribers jumped from 39% to 43%.

While causes of this shift are hard to pinpoint, likely factors are: rising subscription prices, tightened consumer wallets due to the cost of living crisis, and Netflix’s crackdown on account sharing. Increased TV piracy and competition from short-form video content are likely to have also played a role in driving consumers away from paid subscriptions.

Could this trend influence music streaming?

The music streaming market has also shown signs of change, with slowing subscription growth among major platforms. Sony Music’s CEO has even called for charges on ad-supported listening in well-established markets to address the slower premium subscriber growth, and in order to reach their longer-term subscription revenue targets. Notably, one report suggests Spotify has experienced a decline in premium subscribers in the US, the world’s largest music market.

However, Spotify’s ad-supported tier is thriving. By Q3 2024, Spotify’s ad-supported monthly active users (MAUs) hit a record 402 million, an 11% increase from the previous year. While this maintains Spotify’s consistent growth, it could signify current challenges to monetise its ad-supported users. Highlighting this, Spotify’s premium average revenue per user (ARPU) has been declining since 2017, sitting at €4.39 in 2023.

Why this matters for artists

Ad-supported streaming’s growth impacts not only streaming platforms, but also the revenue that artists earn. While estimating streaming revenues is no easy feat, ad-supported listening typically generates less revenue per stream compared to premium subscriptions. For artists, this means fewer royalties if more listeners are opting for ad-supported tiers.

However, this is only concerning if paid subscribers are not rising. For instance, China’s popular Tencent Music’s MAUs have dropped by 52 million over two years, but its paid subscribers grew by 34.3 million. For Spotify, premium subscribers grew 10% year-on-year in Q3 2024, reaching 252 million. While this indicates resilience, the proportion of premium subscribers and MAUs is shrinking in the Western markets.

However, this could be offset by global growth as streaming users shift towards non-Western markets. Spotify’s user base in regions like Latin America, Asia Pacific and the Rest of the World has expanded significantly, growing from 19% to 33% of Spotify’s global users. These regions, though promising in volume, often result in lower ARPU which could negatively impact artists’ streaming revenues. Still, increased subscription growth in these markets could help the continued growth of streaming revenues globally.

What’s next for streaming?

Streaming platforms are adapting to achieve long-term profitability goals. We have seen Spotify diversify into the audiobook market, with its upcoming “Deluxe” subscription tier reflecting efforts to attract higher-paying subscribers. Simultaneously, major labels are acquiring catalogues in fast-growing markets, aiming to capitalise on regional growth.

As music streaming continues to evolve, it will be interesting to see how the industry navigates this dynamic landscape. Whether ad-supported listeners continue outpacing premium subscribers remains to be seen, but the potential implications for artists, streaming platforms, and labels are clear.