India’s online music industry is set to lead streaming this decade

India is tipped to be the biggest market for growth in the music industry in the next few years with a huge audience, a love for technology, and a unique demand for music.

Music streaming has transformed the way that we listen to music in the last two decades. Services like Spotify and Apple Music have become the primary source of music for listeners all across the globe and streaming now makes up 62.1% of total global recorded music revenues.

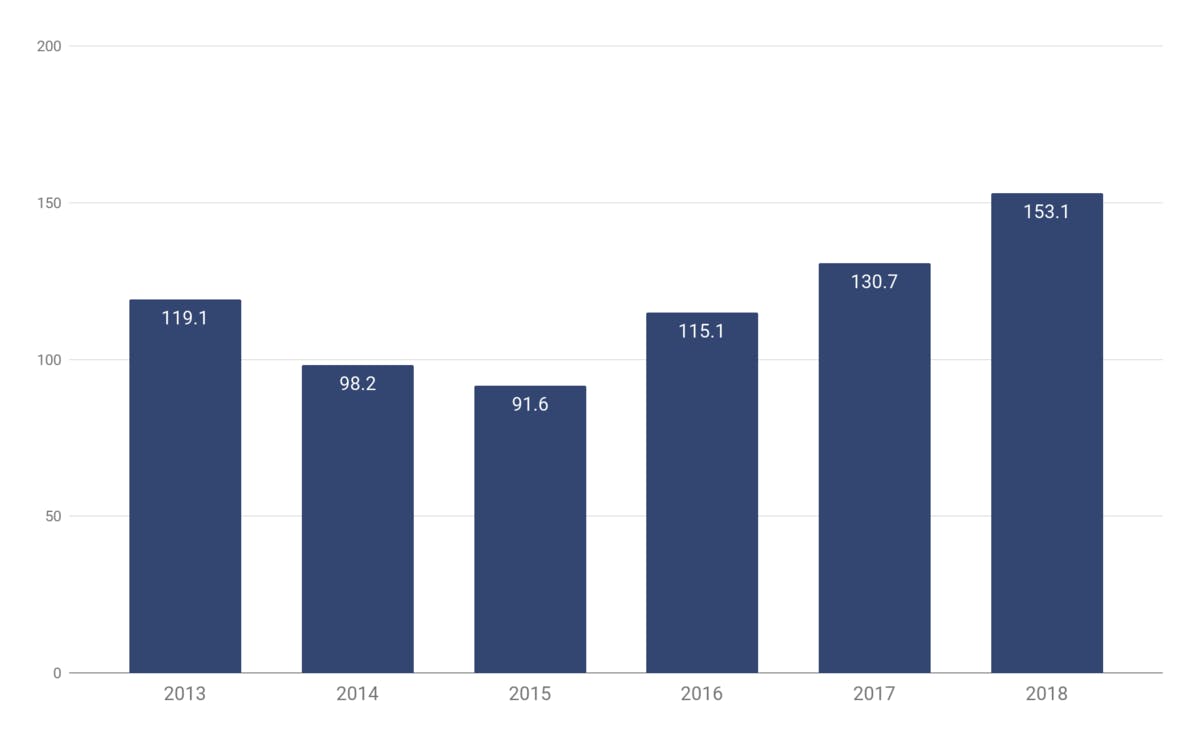

Whilst these streaming platforms have carved their way deeply into our lives in much of the Western world, it’s only in the last few years that parts of Asia have been catching up to the love for digital music services. The music industry is now looking to India’s huge audience as the apex of music streaming growth over the next few years as keen listeners bolster their music revenues from digital services after reaching a low in 2015.

Following years of gradual decline in recording industry revenues in India, they bottomed out at $91.6 million in 2015. India’s music industry was following the same trend that countries around the world had been facing early into the new millennium with the internet bringing the ubiquity of on-demand music to the masses through piracy. Music streaming services became the solution, offering cheap (or free) access to a near unlimited library of the world’s music – that actually paid artists

Now streaming is taking off in India and has revitalised their music economy, following the explosion in internet usage in the mid 2010s. India’s native streaming services Gaana, JioMusic, and Saavn saw significant growth in usership and the last two platforms joined forces to become JioSaavn in 2018 with over 100 million users to date.

Many outsiders like Spotify have only launched in the country in the last few years and whilst they’re seeing healthy growth, they are attracting a fraction of the users that the local platforms have. However, YouTube is a huge presence in India with 245 million Indian visitors each month in 2018, reaching more than 80% of their online users.. Industry insiders predict that the overall streaming user base in India will reach 500 million within the next few years.

With growth every year since 2015, India’s recording industry revenue grew 210% to $153.1 million in 2018, 69% of which was generated by music streaming. With half a decade of sky-rocketing uptake in streaming services for the country it’s showing no signs of slowing, with the first half of 2020 seeing 40% year on year growth in listening for music streaming services.

Source: Deloitte, IFPI, Soundcharts

With music streaming blowing up in India and services with origins beyond Asia clambering to get into the market there, the audience isn’t quite the same in India as in the rest of the world. Whilst music streaming is seeing a huge uptick, it’s not the ready availability of the world’s popular music that is pulling the listeners in.

India’s listeners are unique in that roughly 80% of their streams come from film music, like Bollywood soundtracks. International studio artists only make up a minority of the streams on digital services in the country. This means that – at least currently – the demand for digital music in India, whilst increasingly popular, is heavily insular in the content they look for.

This undoubtedly plays to the favour of local streaming services like Gaana and JioSaavn, who are in a position to easily arrange agreements with the country’s film studios and license film music for streaming. However, it’s likely that the availability of non-film music on these broad, on-demand services will push a cultural shift away from the sole dominance of film music in India’s recorded music industry.

Chairman of the trade body Indian Music Industry and managing director of Indian record label Saregama, Vikram Mehra says: “[For the first] time [since the 1990s], one is seeing enough attention from the label side and enough interest from the customer side for non-film music.” Labels in India are pushing a huge focus on regional language music, for all of the country’s many regions. Undoubtedly international acts will also reach wider audiences with their newfound availability.

As tastes diverge and the user base grows with each year, India is set to have a huge mark in global streaming growth over the next decade as the considerable growth of the last decade slows in markets like the US and Europe, with streaming having reached the majority of the audiences likely to take it up.

It also has a lot of potential to reinvigorate the music revenues for the country significantly more so than it has in recent years. India is currently first in the world for piracy with recent surveys suggesting that 76% of internet users have used pirate services in the last 3 months. With 94% of online consumers listening to music in India, the audience for digital music is already there and converting more and more users away from piracy will see the huge user base on services that insiders are predicting.