Live Nation’s “third quarter marked return to live at scale” with record-high stock

Image Credit: Live Nation

American ticketing company Live Nation recently reported their third-quarter earnings, while stock surged to an all-time high.

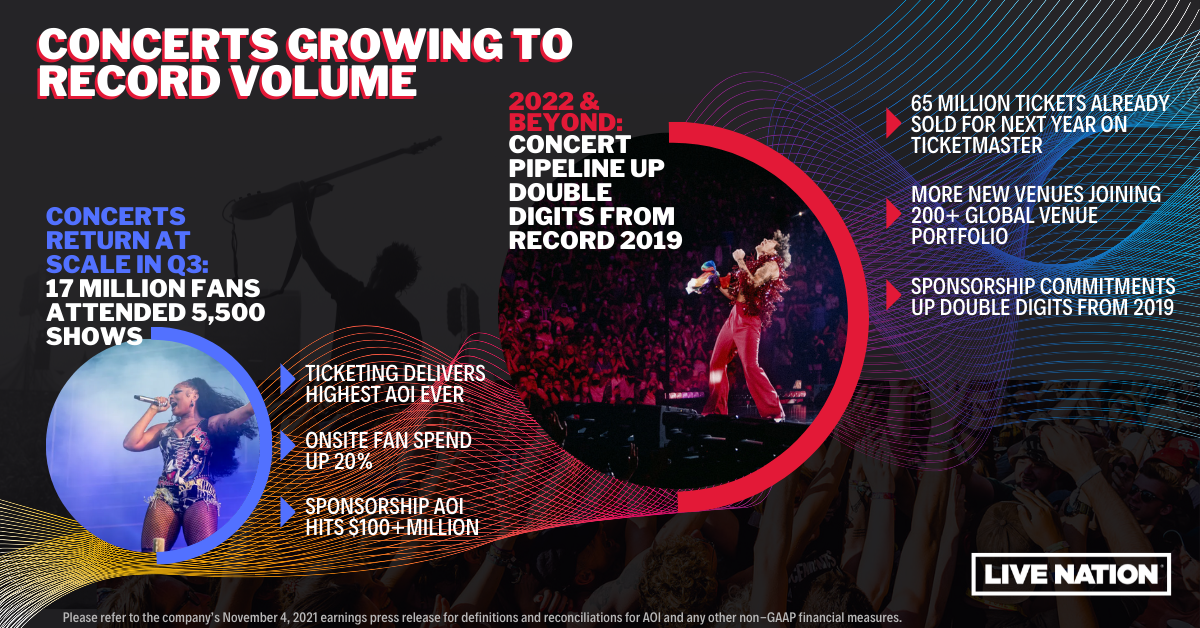

Last Friday, Live Nation Entertainment’s stock saw an all-time high of $127.75 per-share. Now at $115.50, Live Nation has seen a 65% increase since the start of 2021. The company’s recently published third quarter earnings reported equally impressive numbers, with quarterly revenue at almost $2.7 billion, up from $184 million during the same period last year. Concerts and music festivals made up the majority of this revenue, generating approximately $2.15 billion, up from $154.8 million in the same quarter last year. In Q3 2020, Live Nation’s operating income saw a more than $500 million loss, with this quarters income at $137.1 million, while concert losses decreased by $248.8 million year-over-year. Ticketing also rebounded from a $197.4 million loss to surpass a record $114 million gain, and sponsorship and advertising saw a $89 million YoY boost.

Ticketmaster, aquired by Live Nation in 2010, saw improved numbers too, with an income of $374.2 million, against a $19.8 million loss in Q3 2020. “Sponsorship & advertising” also increased from $47.9 million to $174.4 million. Over the first nine months of 2021, Live Nation has made $3.57 billion, with $2.7 billion (over 75%) being from this quarter alone. This year has seen an estimated 7,947 events, up from 360 shows in 2020’s first nine months. The report from Live Nation’s CEO has an optimistic tone discussing Q4 2021 and 2022:

The 2021 summer concerts season rebounded quickly, with 17 million fans attending our shows in the quarter, as the return to live reflected tremendous pent-up demand. Festivals were a large part of our return to live this summer, with many of our festivals selling out in record time and overall ticket sales for major festivals were up 10% versus 2019. And we have had a number of tours already sell over 500 thousand tickets for shows this year, including sell-out tours by Harry Styles, Chris Stapleton and others.

In addition to increased attendance, strong demand also enabled improved pricing, with average amphitheater and major festival pricing up double-digits versus 2019. And at our shows, fans spent at record levels, with on-site spending per fan up over 20% in amphitheaters and festivals compared to 2019.

Michael Rapino, President and CEO, Live Nation

Rapino later states numbers such as:

As we now look forward to 2022, we are encouraged by all our leading indicators across each business. Through October, our confirmed show count across amphitheaters, arenas and stadiums is up double-digits relative to the same time in 2019 for 2020 shows, and through mid-October, we have already sold 22 million tickets for our shows in 2022. Demand has been stronger than ever for many of these on-sales with one million tickets sold for each Coldplay and Red Hot Chili Peppers tours, and several other tours already selling over 500 thousand tickets.

Michael Rapino, President and CEO, Live Nation

The report closes with:

I fully expect we will continue to have bumps in the road in the coming months, and it will take some time for international artists to be touring on a truly global basis, but the fundamental strength of live entertainment and Live Nation has proven out, and I expect we will only continue to grow from here.

Michael Rapino, President and CEO, Live Nation