Germany’s recorded music revenues increased 4.8% in the first half of 2020 despite COVID-19

Thanks to huge continued growth of music streaming, Germany’s recorded music revenues rose, despite physical media taking a hit during the global pandemic.

Coronavirus has negatively impacted a large portion of the recorded music industry in Q2 2020, with physical retail stores closed, shrinking release schedules from labels, reduction in public performance licensing from shop, restaurant, bars, theatres, etc. One area that has seen continued growth, especially during lockdown is music streaming, enough to offset loses elsewhere.

Reported by BVMI, in the first six months of 2020, Germany saw a rise in recorded music revenues as a whole by 4.8% year-on-year to €783.7m ($856m). This covers streaming, downloads, physical music and advertising income.

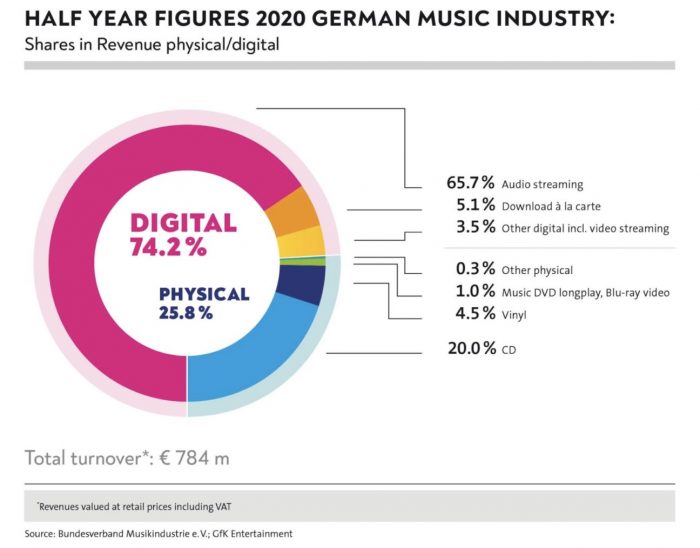

Streaming services such as Spotify and Apple Music generated €514.9m ($562m), up a whopping 20.7% year-on-year. This represents 65.7% of Germany’s total recorded music retail revenues. Digital as a whole represented almost three quarters of the market.

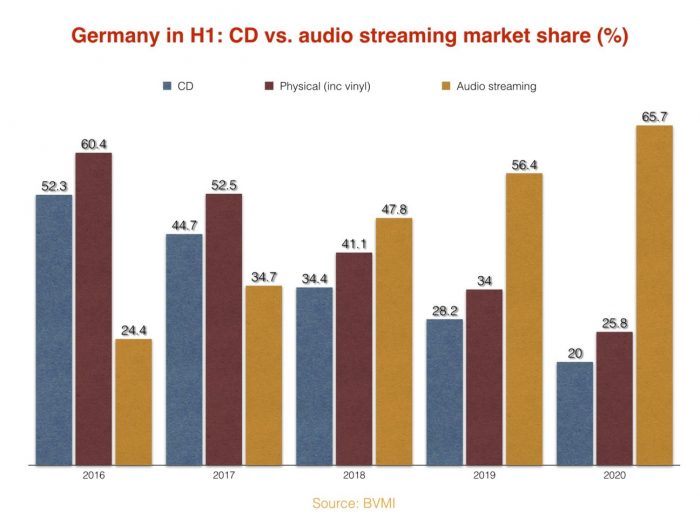

CD sale made up 20% of all recorded music revenues in H1 2020, but unsurprisingly fell by 22.9% year-on-year, generating €156.7m ($171m). All other physical formats such as vinyl fell by 18.6% year-on-year at €202.2m ($221m). Vinyl held 4.5% in the first half of 2020. Downloads also fell by 22.5%, holding just 5.1% of the market share.

Germany are the fourth biggest recorded music market after the US, Japan and the UK. Up until 2017, physical formats made up over half of the market, that year contributing to 52.5% of the market. From then a huge shift has brought revenue from physical to streaming, with help this year from the pandemic.

The fact that the industry as a whole proved resilient during the coronavirus crisis in the first half of 2020 is very pleasing and a result of the successful digital strategy of the member companies in recent years. However, with a digital share of almost 75%, the literal implementation of the Copyright Directive in German law is now the top priority, because this is where the framework is set for the digital growth in the future.

The so-called discussion draft [of the Directive], which the BMJV recently presented, sends the really worrying and therefore unacceptable signal to the industry that a special German path is to be taken here, which neither reflects the Directive as it was originally intended nor the interests of the rights holders.

It is, however, absolutely essential to place these positive figures in the overall music industry context, because the slight growth in our part of the industry must not distract from the extent of the crisis for the live sector – with the devastating effects for artists and all those who participate in the creation of value here.Dr. Florian Drücke, Chairman & CEO, BVMI

This can at best be slightly cushioned by the slight increase on the music sales side, but it is far from being compensated for. This is one of the reasons why we support the demands for state aid measures in a spirit of solidarity.