IFPI report reveals EU music industry is booming with 9.1% growth

Paid streaming leads the charge as the EU outpaces the US, China, and Brazil in recorded music growth.

The EU’s music market is thriving

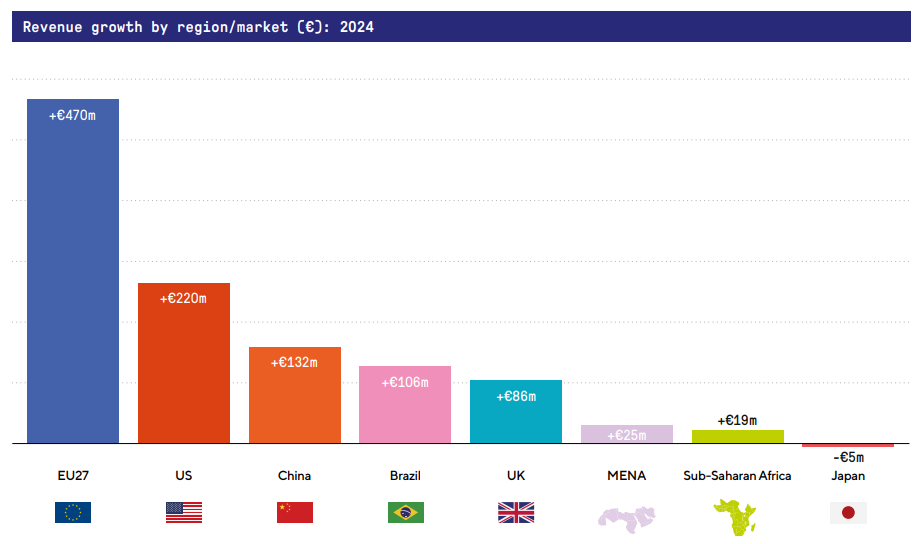

The IFPI’s second ‘Music in the EU’ report has landed. The headline figure? The EU achieved €5.7 billion in recorded music revenues for 2024. That’s a 9.1% year-on-year jump (from €5.2 billion). In fact, by value, the EU’s growth of €470 million outpaced the combined gains of the US (€220m), China (€132m), and Brazil (€106m). That’s more than double of the US, and marks a strong year for the European Union’s music industry.

A streaming-powered push

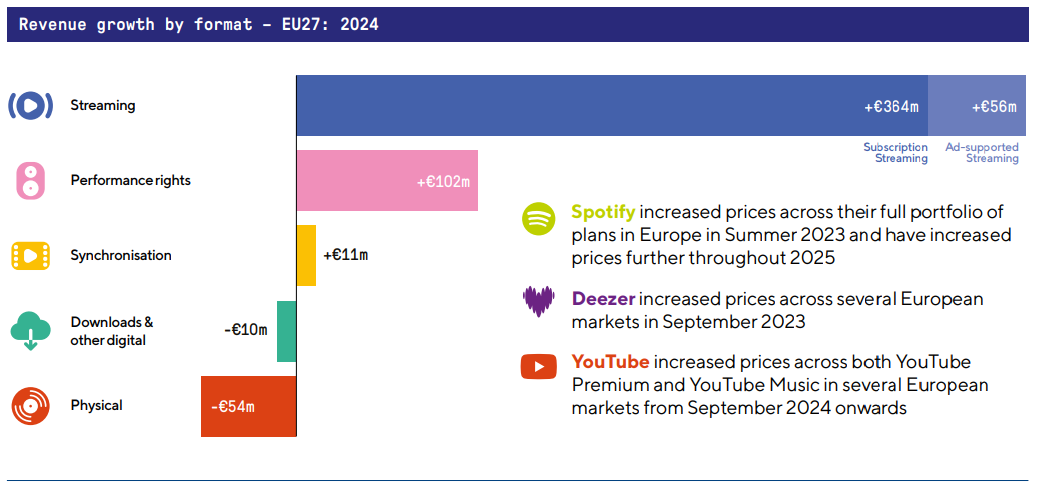

The main driver of EU’s growth? Paid streaming subscriptions. According to the report, 77.4% of the EU’s recorded music revenue growth came from paid music streaming. This comes during a period whereby streaming services have started to gradually increase their prices after years of keeping them still. Take Spotify, for example, who recently announced more price rises were coming to Europe.

While this growth is good news for streaming services, there’s still opportunities for the EU’s record music revenue to grow further. Streaming penetration sits at only 25%, which is lower than major markets like the US (52%) and the UK (46%). That means there’s plenty of untapped potential for further streaming revenue growth in the EU.

What the IFPI wants to see next

Towards the end of the report, the IFPI doubles down on policy recommendations to help power the future of the music industry in the EU.

The main five points are:

- Recognise music as central to Europe’s culture and economy in policymaking decisions.

- Protect the competitive marketplace and its existing free-marketing licensing framework.

- Ensure AI development respects human creativity and complies with the EU’s AI Act.

- Enforce laws, such as tackling piracy and streaming manipulation, to protect artists.

- Strengthen copyright frameworks for a vibrant music ecosystem that’s worth investment.

Of course, AI and copyright are a central focus. As AI gains more influence in the music industry, whether it’s AI-generated tracks or artist deepfakes, ensuring transparency and upholding copyright law is key to addressing many of the challenges ahead.

So, what does this all mean?

The EU’s recorded music market is flourishing, but there’s still room for growth. With streaming penetration still below other major markets, there’s clear headroom to convert more listeners into paid music subscribers.

Couple that with supportive policymaking going forward, and the outlook looks positive for the future of the EU’s recorded music industry. For artists, labels, and the wider industry, the EU market remains one to watch and invest in over the coming years.