US recorded music revenue growth slows in 2024 as subscriptions hit 100 million

The US recorded music industry reaches a historic milestone in paid subscriptions, but revenue growth slows.

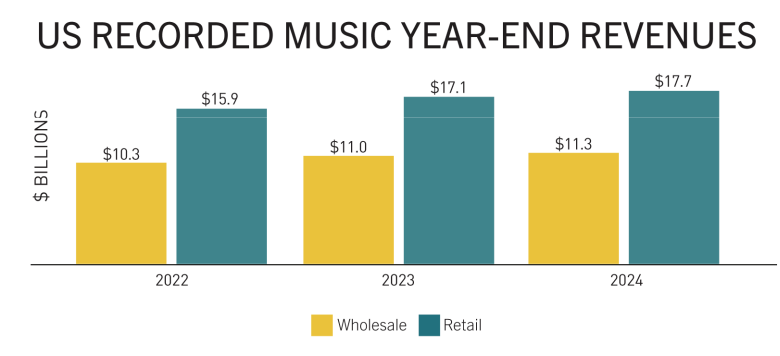

The US recorded music industry generated $17.67 billion in revenue in 2024, according to the RIAA’s latest 2024 year-end revenue report. While this represents a 3.3% year-over-year (YoY) increase, it also marks a slowdown when compared to the 7.7% growth recorded in 2023. This trend raises questions about the future of the industry, particularly in one of the world’s largest music markets.

For comparison, other major music markets experienced stronger growth: Spain’s recorded music revenue grew by 9.4% in 2024, France’s by 7%, and the UK’s by 4.8% as it surpassed £1 billion for the first time.

Streaming continues to dominate but growth slows

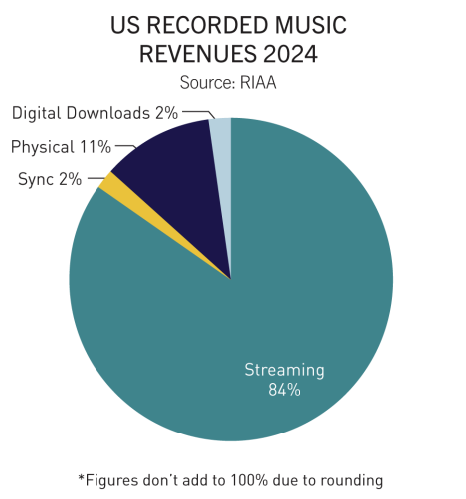

Streaming remains the largest source of revenues, with the number of paid music subscriptions surpassing 100 million for the first time. It’s important to note that this figure represents individual subscriptions as opposed to total subscribers, meaning a family plan counts as a single subscription rather than multiple users.

Paid music subscriptions contributed $10.69 billion in revenue, but the 5.3% growth rate in 2024 was nearly half of 2023’s increase (10.6%). Meanwhile, revenues from ad-supported ‘on-demand’ streaming services declined by 1.8%, and other ad-supported services dropped 3.5%.

Overall, US streaming revenues totaled $14.88 billion in 2024, increasing by 3.6%. However, this marks a slowdown from 2023’s growth of 8.1%.

“20 years into the streaming era, over 100 million paid subscriptions now deliver two-thirds of industry revenues, a historic milestone empowering America’s music economy forward.”

Mitch Glazier, RIAA Chairman and CEO

Physical music sales

Despite the industry’s digital shift, physical music sales continued to grow. However, their rate of growth also slowed compared to 2023.

- CDs: 32.9 million units were shipped in 2024, marking a 1.5% increase in sales volume. However, revenue only grew by 0.7%, reaching $541.1 million.

- Vinyl: The vinyl resurgence remained strong, marking its 18th consecutive year of growth in the US. With 43.6 million units shipped (a 1% YoY increase), total sales grew 6.9% and generated $1.44 billion in revenue.

Still, both formats experience a slowdown in growth. In 2023, CD revenues grew 11.3% (compared to just 0.7% in 2024), while vinyl revenue growth slowed from 10.3% in 2023 to 6.9% in 2024.

What this means for the industry

The slowdown in recorded music revenue growth suggests a plateau in streaming growth within the US. As music streaming growth slows, the industry faces a crucial question: what will fuel the next phase of industry growth?

Major players in the industry are turning to “Streaming 2.0”, an evolution of the streaming model that focuses on superfan engagement and more exclusive offerings. Key to this concept is the idea of premium subscription tiers, exclusive content, and direct-to-fan offerings which could help reignite growth.

As Spotify looks to introduce its own premium “Music Pro” subscription tier, it will be interesting to see whether these new offerings will successfully usher in more revenues for the industry.

Start distributing with RouteNote today and take control of your music career.