Global recorded music market up 6.5% in 2024, hitting $36.2bn

The IFPI’s Global Music Report lands on March 19th, but MIDiA have offered estimates ahead of then.

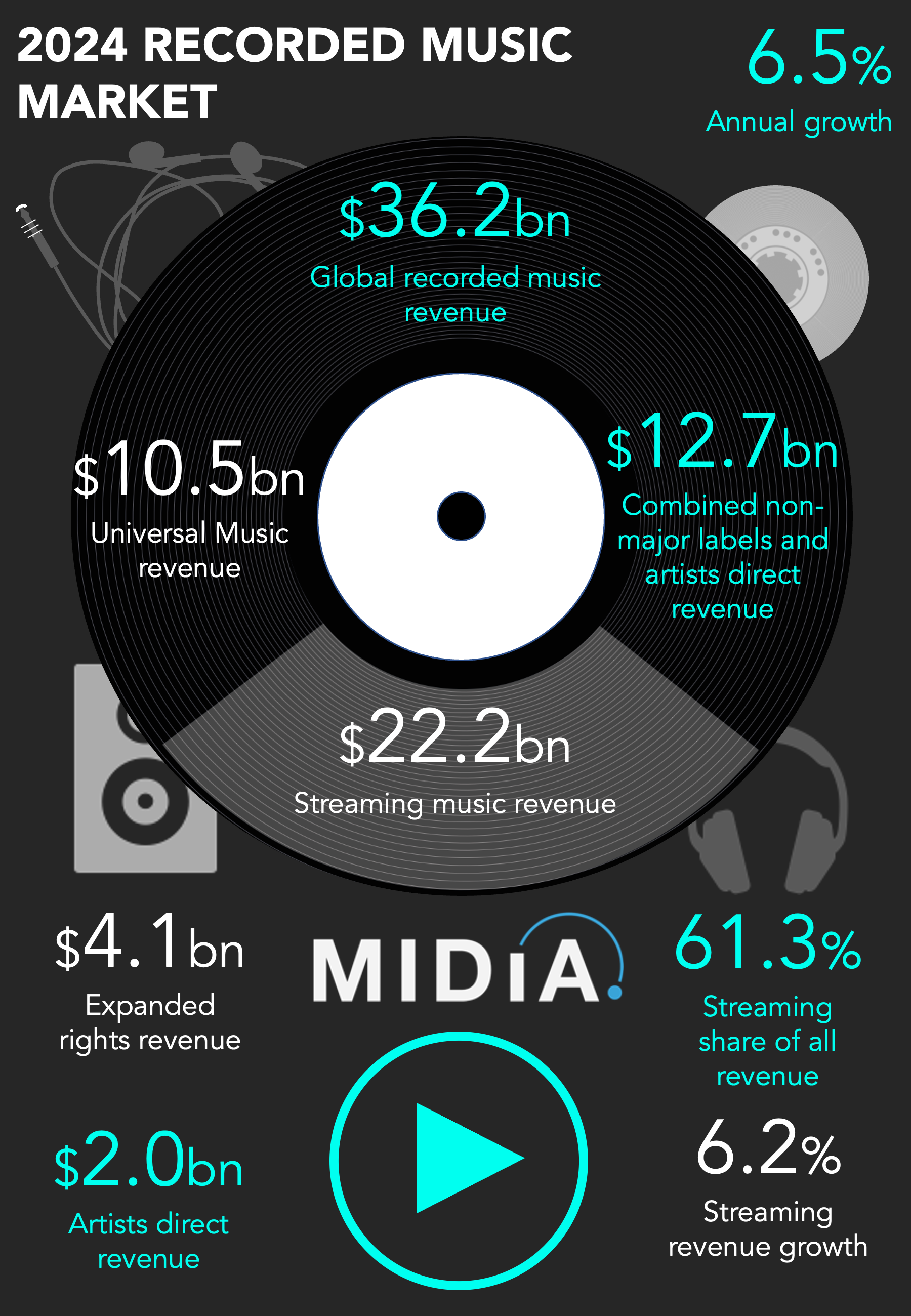

The global recorded music industry generated an estimated $36.2 billion in 2024, growing by 6.5% compared to 2023. These figures, based on MIDiA Research’s latest report by analyst Mark Mulligan, reveal an industry in transition. While overall revenues are still rising, growth is slowing – especially in streaming, which has long been the dominant force in the music business.

Streaming continues to be the industry’s biggest revenue driver, contributing $22.2 billion in 2024. However, its growth rate has slowed to 6.2% – down from 10.3% the previous year. For the first time, streaming’s share of total recorded music revenues did not increase, remaining at 61.3%. MIDiA’s report notes that despite price increases from major services, streaming revenue is beginning to plateau.

“The much-anticipated streaming revenue deceleration – despite recent price increases – has now arrived,” writes Mulligan. “Industry attention is turning to super-premium tiers and new monetization models to re-ignite growth.”

For independent artists, this reinforces the need to explore income streams beyond just Spotify and Apple Music payouts. Relying solely on streaming royalties is becoming less sustainable, making direct-to-fan sales, social media monetisation, and alternative platforms more important than ever.

As streaming growth levels off, the music industry is shifting its attention to ‘expanded rights’ – revenue generated beyond direct music sales, including merchandise, fan experiences, and brand partnerships. According to MIDiA, expanded rights revenues grew by 17% to $4.1 billion in 2024, now making up 11.3% of total recorded music revenues.

Mulligan highlights that this is becoming an essential hedge against slowing streaming growth and the “yo-yoing physical sector”. Expanded rights do “the crucial job of monetizing fandom,” he notes, pointing to the increasing importance of superfans in an artist’s income.

The biggest winners in 2024 weren’t the major labels, but independent artists and smaller labels. According to MIDiA, non-major label revenues grew by 8.4% to $5.4 billion, outpacing the 5.4% growth of the majors. Self-releasing artists – those distributing through platforms like RouteNote – also saw revenue increase by 4.7% to $2.0 billion. However, the number of self-releasing artists grew even faster, reaching 8.2 million in 2024. With more artists entering the space than ever, competition for listeners and revenue is increasing.

This means that independent artists need to think beyond just getting music on streaming services. Strategic promotion, smart use of analytics, and alternative revenue streams – such as selling physical formats or offering subscriptions – are key to standing out.

What does all this mean for independent artists?

For those releasing music independently, MIDiA’s latest report reinforces the importance of taking a broad approach to career growth:

- Diversify revenue streams – Streaming alone isn’t enough. Merch, licensing, and direct fan engagement can provide more stability.

- Build superfans – Casual listeners are valuable, but superfans who buy physical products, attend shows, and engage deeply with your music are even more important.

- Use data to your advantage – Platforms like RouteNote provide analytics that can help artists understand their audience and make smarter marketing decisions.

The recorded music industry is evolving, and independent artists are becoming a bigger part of the landscape. While streaming remains a key income source, those who embrace a multi-platform, fan-focused approach will be best positioned to succeed in this looming new era.