Global music industry sees continued growth in 2024, says IFPI

The IFPI’s report paints a picture of how the global music industry shaped up in 2024.

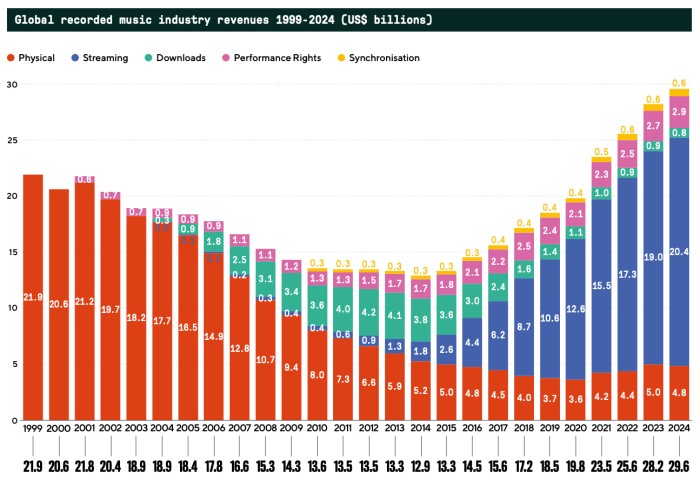

The IFPI (International Federation of the Phonographic Industry) has released its Global Music Report 2025, revealing that global recorded music revenues grew by 4.8% in 2024, reaching $29.6 billion. This comes a few days after MiDIA’s estimated report, which was a little more generous While the growth rate has slowed compared to previous years, the industry continues to expand, driven largely by streaming, regional market developments, and increased investment in artists.

Revenue breakdown

The growth of streaming continues to dominate the recorded music industry, with paid subscriptions showing notable increases, while physical sales, particularly CDs, are on the decline. Despite this, vinyl is still going strong, experiencing its 18th consecutive year of growth. In addition to streaming and physical sales, other revenue streams like performance rights and sync licensing are also contributing to the overall revenue picture, showing signs of recovery and expansion.

Streaming dominance

- Streaming revenue surpassed $20 billion for the first time, making up 69.0% of total recorded music revenues.

- Paid subscription streaming grew 9.5%, with 752 million users worldwide (+10.6% year-over-year).

- Ad-supported streaming revenues remained stable but grew at a slower rate than paid subscriptions.

Physical sales and vinyl resurgence

- Physical format revenues dropped by 3.1%, following a strong 2023.

- Vinyl sales grew by 4.6%, marking the 18th consecutive year of growth for the format.

- CD sales declined, especially in North America and Europe.

Other revenue streams

- Performance rights revenues (income from public performances of recorded music) grew 5.3%, recovering from the pandemic slump.

- Sync licensing (music in films, ads, video games, etc.) increased by 7.4%, with more brands and content creators using licensed music.

Regional music market trends

The global music market shows varied growth, with North America leading in revenue but slow growth. Europe is expanding, with streaming rising, while physical formats remain strong in some countries. Latin America sees significant growth, driven by streaming and social media, while the MENA region – the fastest growing region – leads in digital consumption. Sub-Saharan Africa’s mobile streaming is driving growth, and Asia and Australia are shaped by local markets like China, South Korea, and Japan, each with unique trends.

North America (USA & Canada)

- Largest share of global revenue (40.3%), but growth was only 2.1%, the slowest among major regions.

- Subscription streaming is mature, but new growth is coming from catalog sales, sync, and licensing deals.

Europe

- The second-largest region saw 8.3% growth, with Germany, UK, and France leading the charge.

- Streaming continues to expand, but physical formats remain more popular in certain European countries than elsewhere.

Latin America

- 15th consecutive year of growth, with a 22.5% revenue increase.

- Brazil and Mexico dominate, driven by streaming and social media platforms.

Middle East & North Africa (MENA)

- Fastest-growing region globally, with 22.8% growth.

- Streaming makes up 99.5% of total revenue, as digital music consumption expands rapidly.

Sub-Saharan Africa

- Revenues grew 22.6%, crossing $100 million for the first time.

- Growth is driven by mobile streaming and partnerships with telecom companies.

Asia & Australia

- Australia dropped off the top 10 music markets for the first time in almost 30 years, being replaced as 10th on the list by Mexico.

- China and South Korea lead the Asian market, with K-pop and C-pop playing major roles in international music exports.

- Japan remains a strong physical market, though streaming is slowly expanding.

- India’s streaming market is growing, but monetisation remains a challenge due to lower subscription prices.

Record labels and artist development

Major labels remain the largest players in the market, but independent labels and self-releasing artists are capturing more market share. Labels are focusing more on artist development and digital marketing to remain competitive. While AI tools are being used to identify talent, human expertise continues to play a vital role in artist development.

- Major record labels (Universal, Sony, Warner) continue to dominate, but independent labels and self-releasing artists are gaining market share.

- Labels are investing more in artist development and digital marketing to stay competitive.

- AI-powered tools are now being used to help identify talent, but human expertise remains key in artist development.

Music industry policies and AI regulation

The report highlights concerns about generative AI being trained on copyrighted music without consent, with the IFPI calling for stronger regulations to protect artists. AI should support creativity, not replace it. Meanwhile, more artists are opting for direct distribution deals with streaming platforms, bypassing traditional labels, and shifts in monetisation models on TikTok and YouTube are changing how royalties are earned. Stricter music copyright enforcement, particularly for AI-generated content, is also on the rise.

Artificial intelligence and copyright concerns

- The report warns that generative AI is being trained on copyrighted music without consent.

- IFPI calls for stronger regulations to protect artists and rights holders.

- AI should be used to support human creativity, not replace it.

Music licensing and market changes

- More artists are signing direct distribution deals with streaming platforms, bypassing traditional label deals.

- TikTok and YouTube’s evolving monetisation models are shifting how music royalties are earned.

- Music copyright enforcement is becoming stricter, especially for AI-generated content.

Summing up

In conclusion, the global music industry continues to grow, driven primarily by streaming, which now accounts for most of the revenue. While vinyl sales remain strong, regions like Latin America, MENA, and Sub-Saharan Africa are seeing significant growth, especially through streaming. Independent artists and labels are gaining market share, with digital marketing and AI tools playing a larger role, though human expertise in artist development remains key.

Concerns over AI-generated content and copyright infringement have led to calls for stricter regulations. Meanwhile, evolving monetisation models on platforms like TikTok and YouTube are changing how royalties are earned. The industry is adapting to digital shifts, creating new opportunities while navigating these challenges.

For more music industry updates, news, and insights, head to the RouteNote blog.