Local artists lead EU charts, but global reach falls short in 2023

A new report on music in the EU reveals that local artists dominated EU charts last year, however recorded music revenue growth is potential cause for concern.

A fresh report from the IFPI – titled, “Music in the EU” – has revealed that listeners in Europe are massive fans of domestic artists. Full of compelling statistics, the report also suggests that recorded music revenue growth in the EU in 2023 signals danger of “falling behind”.

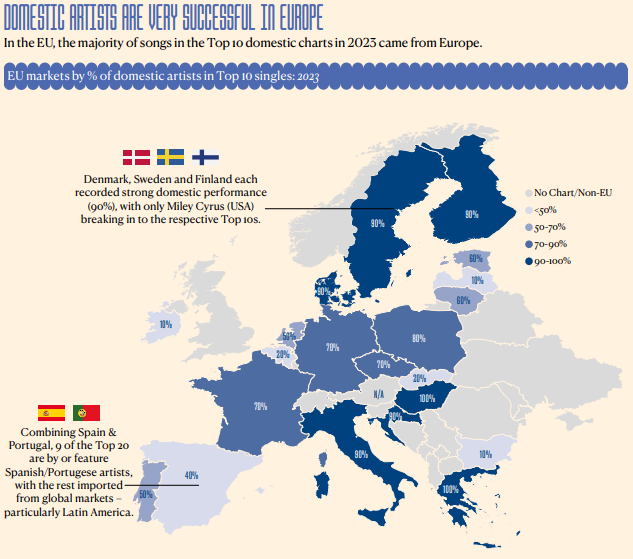

Dominance of domestic artists

In 2023, local artists overwhelmingly dominated the European music scene, with 60% of the Top 10 tracks across 22 EU countries coming from domestic talent, according to the IFPI.

Countries like Denmark, Sweden, and Finland saw even higher percentages, showcasing the strength of homegrown acts. In Italy, nearly 75% of chart-topping songs were by local musicians. Only one international artist managed to break into these countries’ top 10s – Miley Cyrus.

This surge reflects Europe’s strong connection to regional culture, with listeners gravitating towards familiar voices, yet this dominance contrasts starkly with Europe’s limited global music exports. The focus remains heavily local despite the EU’s ambition for broader international reach.

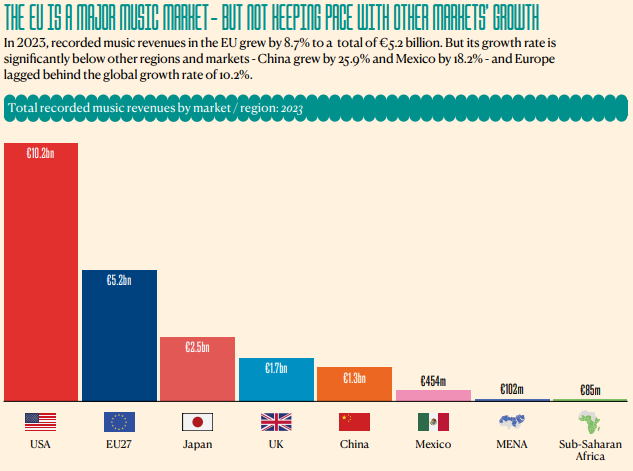

Contrasting recorded music revenue growth

While European music markets saw moderate growth in 2023, global competitors outpaced the region significantly. The EU’s recorded music revenues grew by 8.7%, a respectable figure but far behind markets like China, which surged by 25.9%, and Sub-Saharan Africa, up by 24.7%. Among the EU, Bulgaria led with a 30.4% revenue increase, while Finland experienced one of the lowest growth rates at just 1.2%.

This disparity highlights the EU’s relatively sluggish progress in the global music industry, where emerging markets are experiencing rapid expansions.

Struggles with EU music exports

Despite local dominance within EU charts, Europe struggles to export its music globally. In 2023, only 25 EU tracks made it into the Top 10 charts outside the region, underscoring Europe’s limited reach compared to markets like the U.S., Latin America, and the global rise of K-pop.

Even powerhouse EU countries like France and Germany have been unable to match the international success seen in other regions. This lack of global penetration remains a significant hurdle for Europe as it seeks to expand its music’s influence worldwide.

Challenges and opportunities for European music

Europe’s limited success in exporting music highlights challenges but also offers significant opportunities. While the EU dominates local charts, its global reach remains relatively weak. Addressing this gap requires better support for cross-border promotion and stronger investment in global marketing. IFPI CEO, Victoria Oakley has commented on the risk Europe’s music revenue faces, but also how these fears can be addressed.

“Today, European music faces great risk but also great opportunity. How policymakers address these issues will help determine its future.”

Victoria Oakley, IFPI

The rise of emerging markets like China and Sub-Saharan Africa signals areas for growth, if European artists can manage to adapt and appeal to diverse audiences. With strategic industry shifts, Europe has the potential to reassert its influence on the global stage.