UK live music spend hits a record £6.7bn in 2024, but grassroots venues still face mounting pressure

LIVE’s annual report shows the UK’s live music scene is booming thanks to mega tours, but smaller venues and festivals are struggling to keep pace.

A record-breaking year for live music in the UK

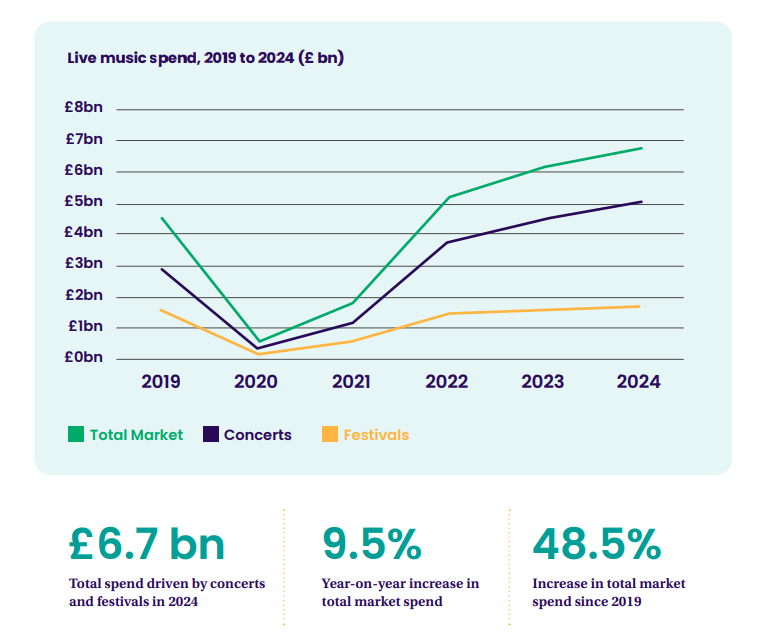

The UK’s music industry body, LIVE (Live music Industry Venues and Entertainment), has revealed that the UK’s live music industry hit new highs in 2024. Consumer spending on gigs, concerts, and festivals reached a huge £6.68 billion- a 9.5% jump from 2023. That’s more than £2 billion above pre-Covid levels, and 28.2% higher than the first full year back after Covid in 2022. In other words, the live music industry is thriving.

LIVE analysed data from 55,000 shows and events, revealing that there was essentially “one gig every 137 seconds across the UK” last year. All-in-all the appetite for live music looks pretty strong.

Superstars driving the boom

Most of the growth has been attributed to superstar tours. Taylor Swift’s Era Tour, Charli XCX’s Brat Summer, and Bruce Springsteen’s UK run were huge drivers, which helped draw in 23.5 million music tourists.

Here’s the downside: while arena and stadium shows are thriving, those within grassroots are still struggling.

“UK live music continued the post-lockdown trend of strong performance for the biggest names at the biggest venues, while pressure built across our grassroots as venues closed, tours were cancelled or cut back, and festivals called time.”

Jon Collins, LIVE CEO

Concerts vs festivals

Despite the overall increase in spending, not all areas of the live sector are growing at the same rate. Concert spending grew by 12.2%, rapidly outpacing the spend growth at festivals (1.9%). As a result, concerts made up 75.3% of total live music spend, growing almost 2% year-over-year (YoY). Pretty much, the increased concert spend took away from the festival spend in the process.

Why the difference? Inflation and rising ticket prices across the board are forcing fans to prioritise. With so many major headlines in town, many music fans are forced to choose between a single-day concert and a festival. The result? Many opt for the major headliner. Instead, 78 festivals shut down in 2024 and that’s a worrying trend for the grassroots ecosystem.

A genre breakdown

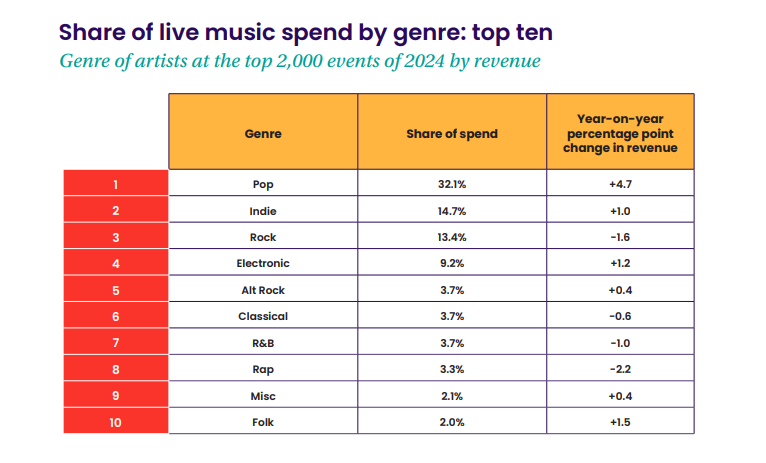

When it comes to spending by genre, pop leads the way. Among the top 2,000 concerts for the year, pop gigs accounted for 32.1% of consumer spend- largely driven by Taylor Swift’s Eras Tour which is estimated to have generated around £1 billion alone.

Indie and rock followed at 14.7% and 13.4% respectively.

What about employment?

The UK’s live music sector employed more than 234,000 people in 2024, a 2.2% YoY increase and 11.9% more than pre-Covid (2019). But, here’s the flip side: 78.8% of workers were casual staff. This marks a trend post-Covid whereby freelancers, temporary workers, and agency staff have now become a backbone of live music.

Unfortunately, this work isn’t always reliable either. Nearly half of workers (48%) said jobs were cancelled with less than a week’s notice, and 49% even signed contracts before agreeing the role.

London leads the way by location

Unsurprisingly, London tops the list when it comes to consumer spending by region. 28.9% of consumer spending took place in the capital. However, Manchester also saw increases, thanks to the opening of the Co-op Live arena. Meanwhile, more rural areas in central England and the South West benefit heavily due to festivals, which shared 39.3% of festival spend in 2024.

Looking ahead

LIVE concluded their report by emphasising their aims to further empower the UK’s live music industry into the future. It’s clear that grassroots are still struggling, and the LIVE Trust’s proposed £1 ticket levy on arena and stadium shows would funnel money back into grassroots venues. The Royal Albert Hall recently became the first 5000+ capacity venue to back the movement.

Alongside this, LIVE urged for more government support. Of which, they note the Association of Independent Festivals’ push for tax relief for festival promoters, which would help struggling organisers to stay afloat.

The overall message is clear: the UK’s live music industry is booming, but without targeted support, the grassroots that fuel tomorrow’s headliners could fade away.

You can read the full report here.