What is Pandora and how to upload your music free

While only available for streamers in the US, artists from around the world can upload their music to Pandora for free with RouteNote!

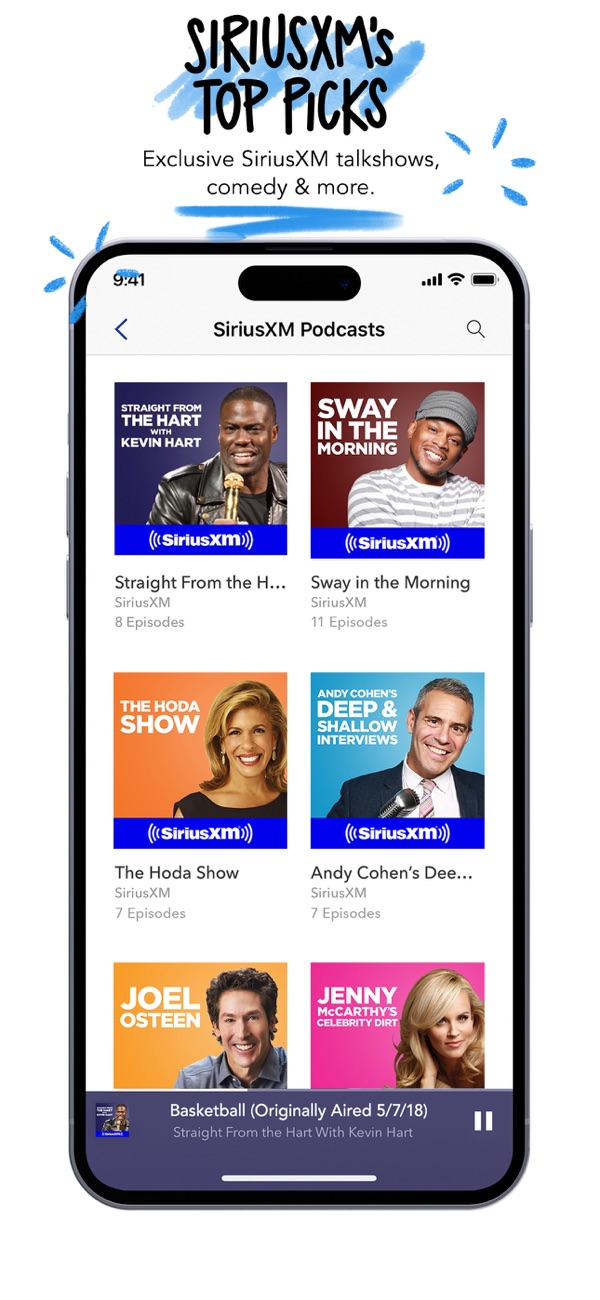

With over two decades in the business, US-based music streaming service Pandora operates a little differently from all other streaming services, for both listeners and artists. Now a subsidiary of SiriusXM, Pandora specializes in curated stations and playlists, as well as personalized music and podcast recommendations that continually evolve with your tastes.

Click below to jump to one of the following:

How to upload to Pandora

RouteNote has long been partnered with Pandora to offer distribution to all independent artists and labels. This is in contrast to competitors UnitedMasters who charge extra for distribution to Pandora.

Distribution to Pandora works a little differently to all of the other over 100 stores available for distribution on RouteNote. That being said, you can still get an unlimited number of your tracks on Pandora, free of charge. To get started, distribute your music using RouteNote:

- Sign up for a free RouteNote account

- Head to the Distribution tab and click Create New Release

- Fill out the text fields with your release metadata, upload your audio and upload your artwork

- In the Manage Store page, select the territories and stores you wish your music to appear in. Be sure to tick the Pandora checkbox.

Your final decision is whether to distribute your release using our Free or Premium tier. RouteNote Free has zero upfront or recurring fee, while you keep 85% of the revenue generated. RouteNote Premium has a small upfront fee (which depends on release-type) and a $9.99 annual cost. You can switch any release to either tier at any time!

For larger artists and labels that require dedicated services, please get in touch and ask about All Access.

Regardless of the tier you choose, artists always retain 100% ownership of their music. Beyond cost, there are no differences in features, stores or support between our Free and Premium tiers.

Now that you’ve uploaded your release to RouteNote, your music will be sent to our moderation team, who will check your release for formatting errors and copyright content. All being well, we should be able to approve your release in around 72 hours, however please note, moderation times can extend during busy periods.

After approval, your release will be sent to our distribution team and then sent to your chosen stores. We aim to get your release live on most stores within a week or two.

As Pandora is a curated collection, you must also submit your release directly to Pandora via AMP for it to be available for streaming here. Find step-by-step instructions on claiming your Pandora artist page here.

So you’ve done it! You’ve sent your music to RouteNote and Pandora, and it’s now streaming on stores around the world. As these streams and purchases come in, RouteNote provides artists with statistics and payments 45 days after the close of each month. This means you’ll receive your January earnings from March 15. Audio recording royalties on Pandora are collected by SoundExchange.

What is Pandora?

Although the last five years have been rocky, with increased competition from rivals Spotify, Apple Music and other music streaming services, Pandora has an interesting story. Launching all the way back in 2000, Pandora soon became a popular way for US users to access music.

How did Pandora start?

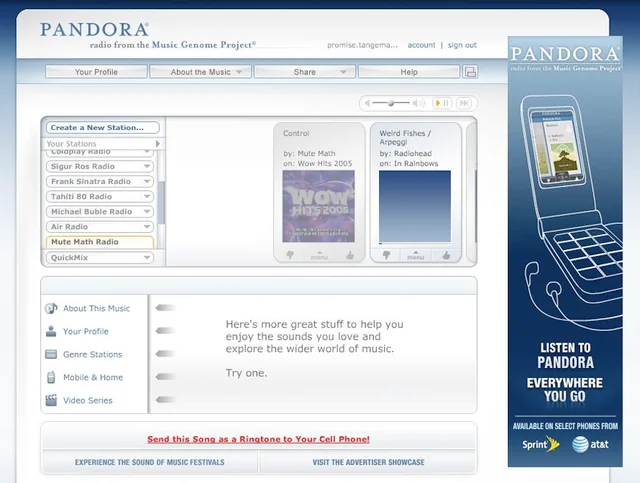

Founded in 2000, Pandora, or Savage Beast Technologies as it was named for the first five years, launched in a time before Spotify and even the iTunes Store, just at the start of the digital music revolution, while Napster’s peer-to-peer file sharing was thriving.

As Savage Beast Technologies, they were a B2B company, licensing the Music Genome Project to retailers. Come 2005, Savage Beast Technologies would shift to the consumer market and launch Pandora as a subscription-only internet radio service, using the Music Genome Project as a personalization system. Later in the year, Pandora added a free, ad-supported version.

Over the next few years, Pandora saw slow but steady growth. By 2010, there were 45 million registered users. This growth saw Pandora go public in 2011, with a valuation of around $2.6 billion. At this time, Pandora had 800,000 tracks from 80,000 artists and 80 million users. The following year, this number had rocketed up to 125 million users. In 2013, Pandora had 200 million registered users and 70 million monthly active users.

In 2013, Pandora accounted for 70% of all internet radio listening in the US and started making a measurable impact on traditional radio. By 2014, Pandora had roughly doubled its library size, to over 1.5 million songs. The following year, Pandora reported it had received more than 50 billion thumbs up from users. The same year, Pandora bought Rdio’s assets for $75 million after it declared bankruptcy, retaining 100 employees.

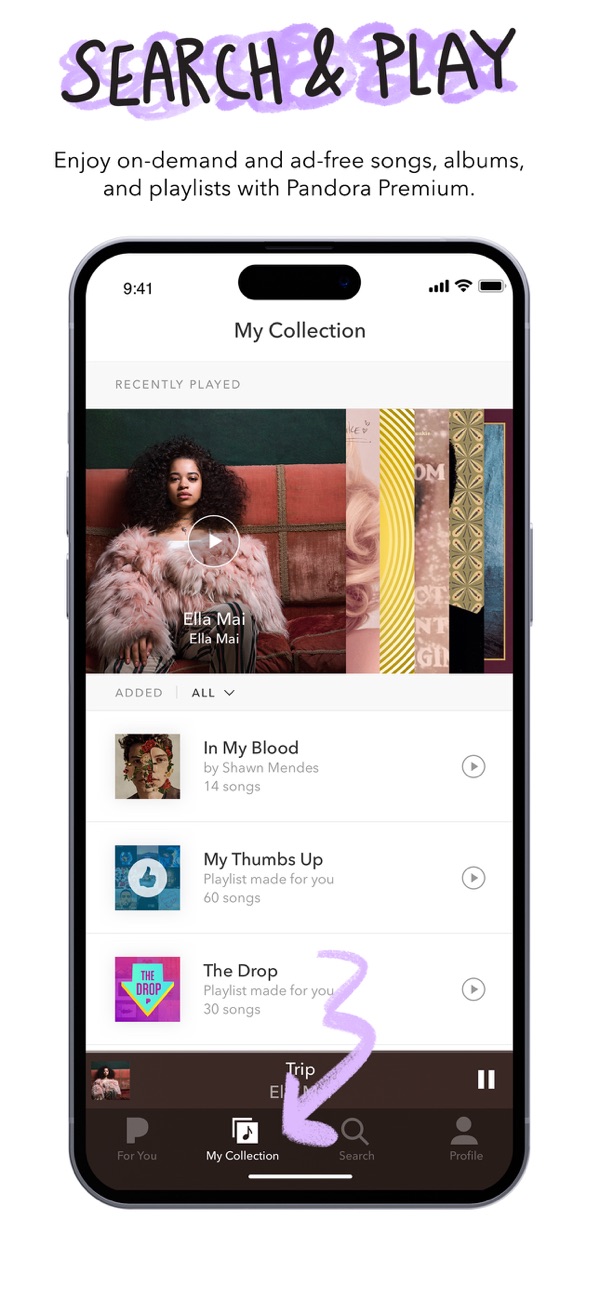

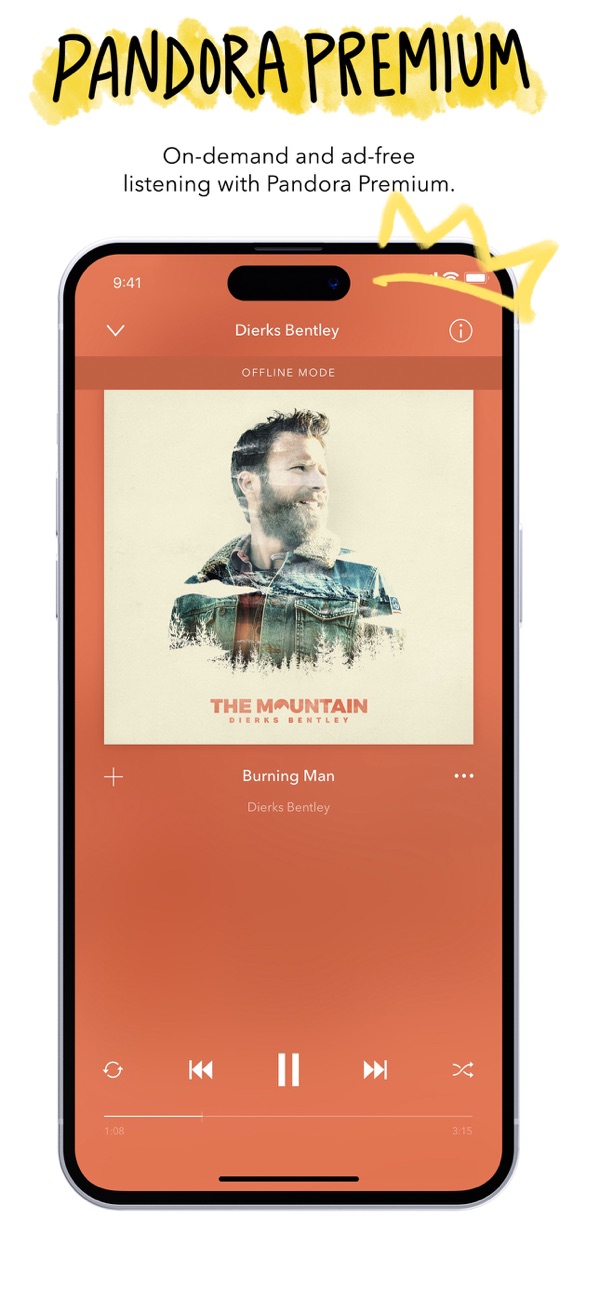

In 2016, Pandora launched a third tier, Pandora Premium which allowed users to listen to and create playlists of individual songs on-demand, in line with other music streaming services, like Spotify and Apple Music. At this time, Pandora reported that 56 million of its 81 million active users subscribe to Today’s Country station, and that country music accounted for more than 1.7 billion listening hours on the platform the previous year. To put focus on the US, in 2017 Pandora discontinued its service in Australia and New Zealand. Since the start of 2017, streams on Pandora count towards Billboard’s charts.

In 2018, Pandora acquired AdsWizz for $145 million, for its ad-supported tiers. The same year, Pandora reported a reduced 71.4 million active users, due to mounting competition from the likes of Spotify and Apple Music. After initial investment in 2017, an agreement from both sides in 2018 and approval soon after, in 2019, Sirius XM Holdings acquired Pandora for $3.5 billion in stock. 2019 also saw a few new features for artists, including song credits, to see who contributed to tracks, and Pandora Stories, a widely used marketing tool, for artists to build music playlists with voice tracks to add narrative and deeper insights.

Over the next couple of years, users continued to decline, with 60.9 million monthly active users in 2020. 2020 saw Pandora partner with Chartmetric, allowing users to view and compare track data.

Most recently, Pandora reported 46.5 million monthly active users and 6.1 million subscribers by the end of Q3 2023. While users have been declining since 2016, Pandora is today the largest ad-support audience entertainment streaming service in the US.

The basic features of Pandora

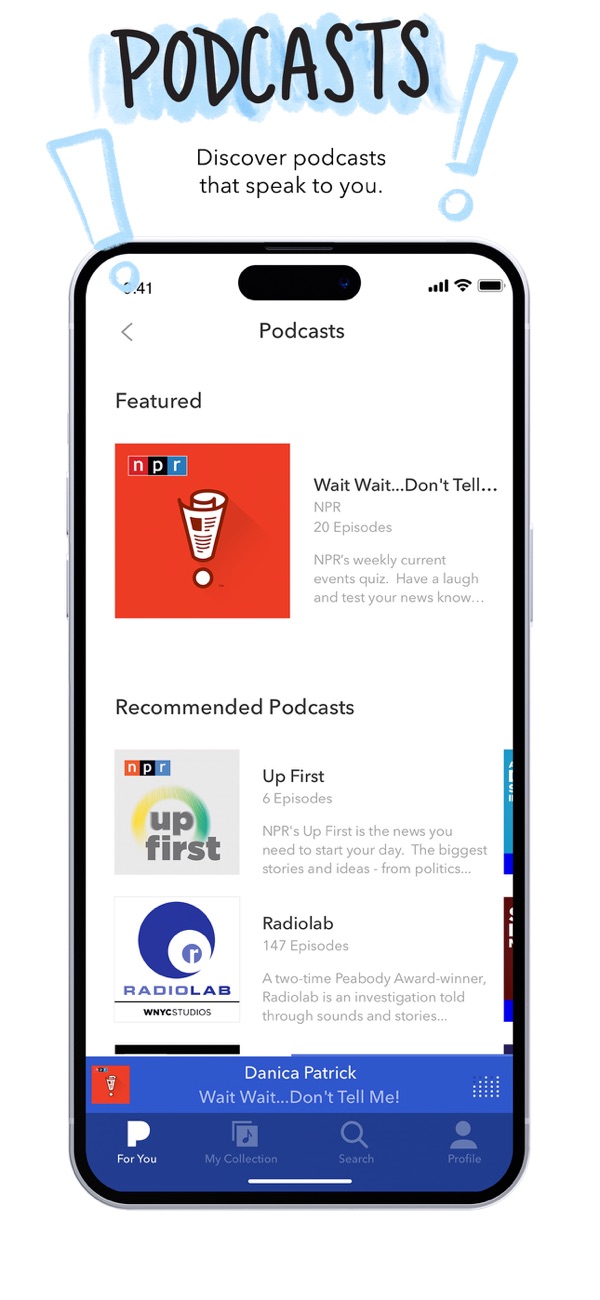

At the core of Pandora’s technology, since the start, is the Music Genome Project, and more recently the Podcast Genome Project. More than 450 musical attributes are considered when selecting the next song, which are combined into larger groups of 2,000 focus traits. These range, with things like rhythm syncopation, key tonality and vocal harmonies analyzed before picking the next track. All of this ensures that the music you hear is tuned to your musical interests.

Due to the personalization element, Pandora really shines when it comes to stations. This includes established genre stations, other users’ stations or even the stations you create. Continue to train the algorithm to your likes using the thumbs up and thumbs down. A thumbs down immediately skips a song and a second thumbs down bans that artist from the station.

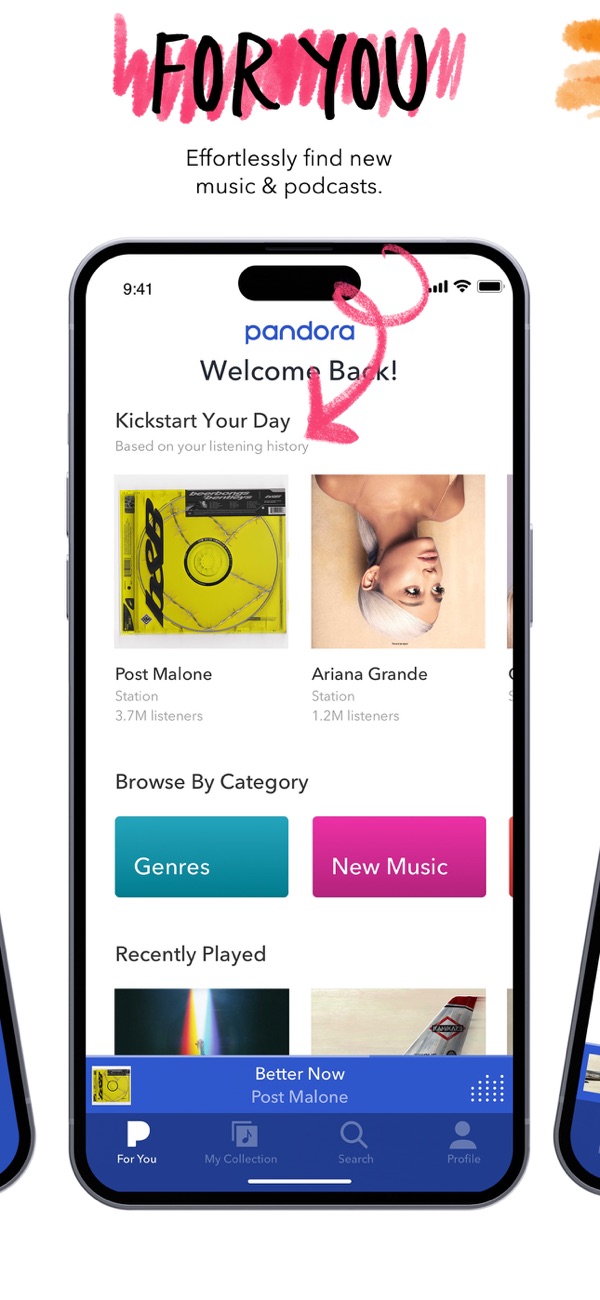

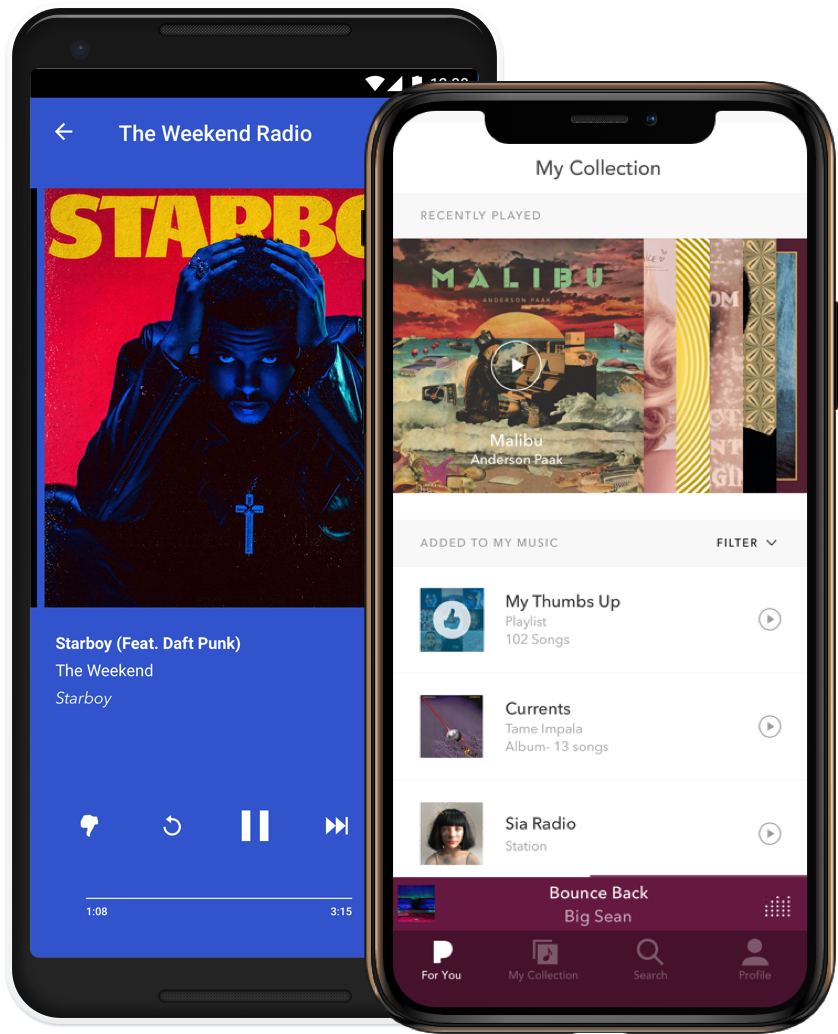

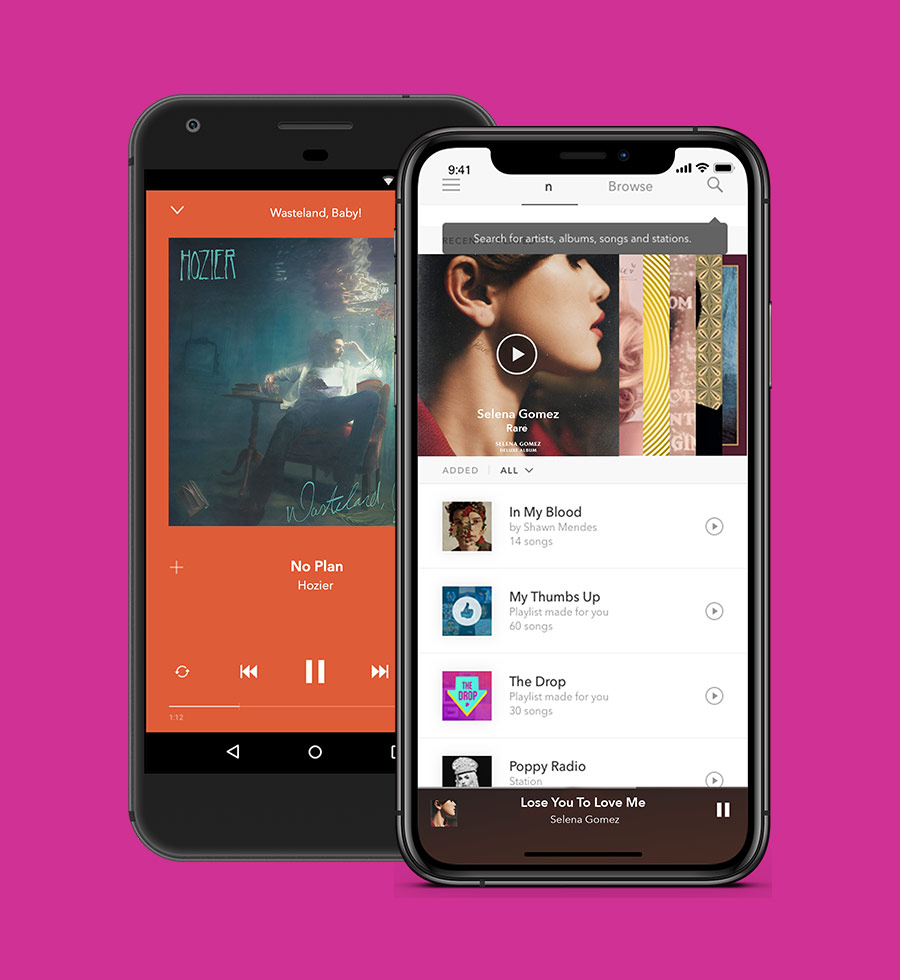

Open up the Pandora app and you’ll be faced with a familiar interface that is reminiscent of competing music streaming services, with a few unique quirks. The mobile app is laid out with four key pages: For You, My Collection, Search and Profile.

The For You page is the app’s homepage. Here you will find a personalized collection of suggested music and podcasts based on your listening habits, including recommended stations (such as Thumbprint Radio and Qmunity), charts (such as Top Thumb Hundred and Thumb 20), featured and personalized playlists (such as Game Time, as well as those from top artists), categories, podcasts and recently played.

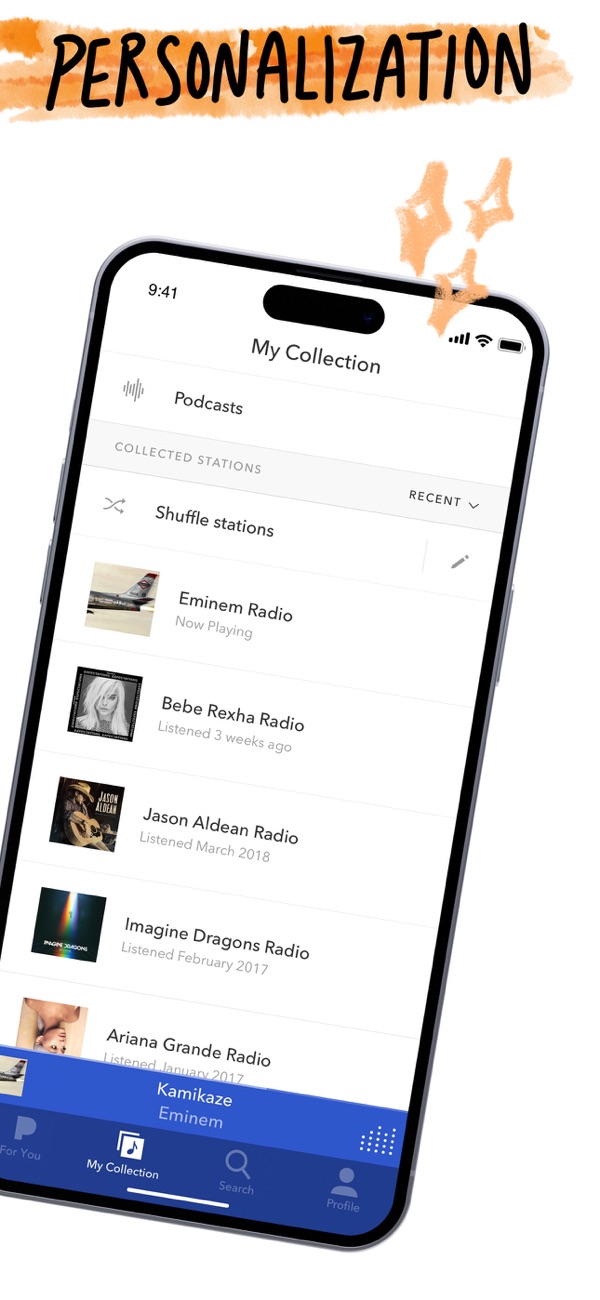

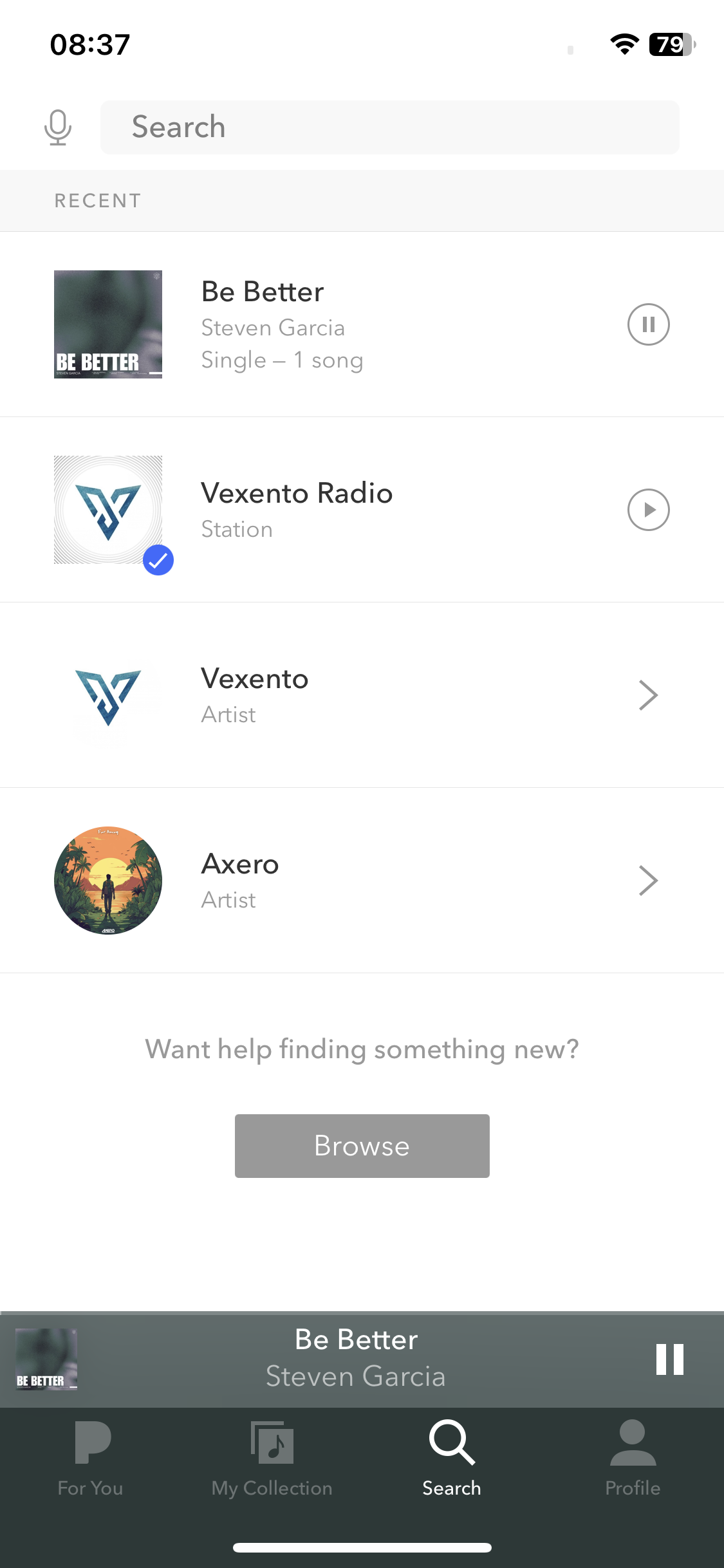

Next up is My Collection. This is your recent stations, suggested stations and saved content, such as saved stations and podcasts. To add new content to this page, simply tap the + button.

Search allows you to quickly find any artist, album, song, station, playlist or podcast. Tap the microphone icon to access Pandora’s built-in assistant.

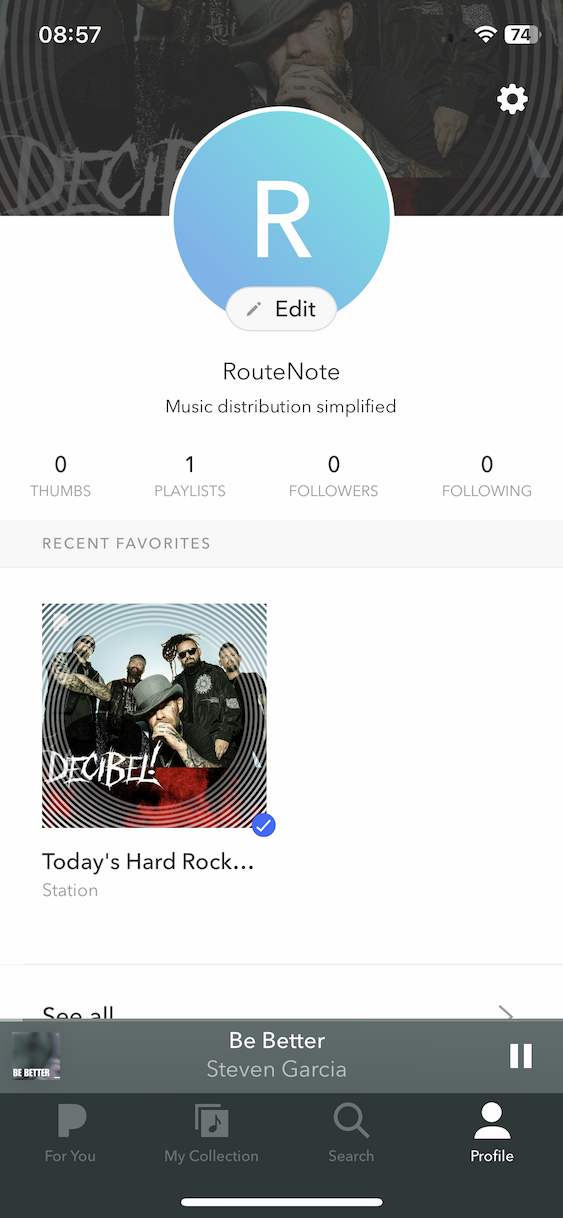

In Profile, you can find an overview of your account. Here you’ll see how many thumbs, stations, followers and following you have, as well as recent favorite stations and top artists. You can also edit your profile information and account setting here too.

When playing any music or podcast on Pandora, you’ll see a small banner at the bottom of the screen displaying the track and artist name. Tapping this will open the Listen screen. Here you can see what you’re listening to, play and pause, skip forwards and backwards, thumbs up and down, switch on repeat and shuffle, add to your library, create a station from the track or artist, cast to speakers, and find more information on the artist and song. From this screen, you can also share your favorite songs on platforms, like Instagram Stories, Snapchat and iMessage.

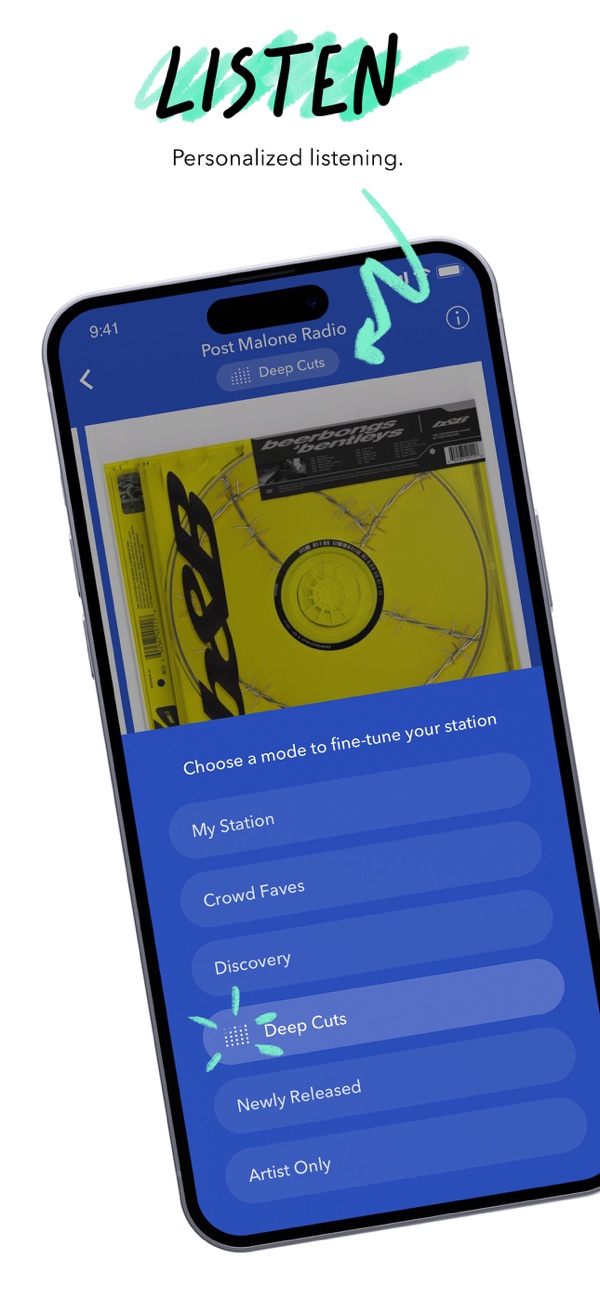

At the top of the Listen screen, tap the small panel to switch Pandora Modes. There are six Pandora Modes to choose from, which personalize stations to your preferences:

- My Station: The station experience you know and love.

- Crowd Faves: Hear the most thumbed-up songs by other listeners.

- Deep Cuts: Hear less familiar songs from station artists.

- Discovery: Hear more artists who don’t usually play on this station.

- Newly Released: Hear the newest releases from station artists.

- Artist Only: Hear songs from the station artist.

For any questions you have on Pandora, be sure to visit the Community, Pandora’s forum.

What countries is Pandora available in?

Although they once were streaming in Australia and New Zealand, today Pandora is only available in the United States due to licensing restrictions. Attempting to access pandora.com from a different country directs those looking for “some up-and-coming music artists” to SoundCloud, due to the investment SiriusXM has in SoundCloud.

The best way to check your release is live on Pandora outside of the US is to use a VPN, but be sure to first read Pandora’s terms and conditions.

Find the best alternative to Pandora available outside of the US here.

Pandora subscription types

Pandora is available free-of-charge with ads. On the free tier, you can get access to personalized radio stations and podcasts, with limitations, such as only being able to search for, play and skip tracks once you’ve watched a video ad.

Pandora Plus is free for the first 30 days, then $4.99 per month or $54.89 per year. Plus unlocks ad-free music, unlimited skips, replays, higher quality audio (192 kbps MP3) and up to four stations for offline listening. While not offering the full on-demand, offline experience of the Premium plan or other $10-$11 subscription-based music streaming services, Pandora Plus is in a rare position of offering ad-free music for under $5 a month or under $55 a year.

Pandora Premium is free for the first 60 days, then $9.99 per month or $109.89 per year for individuals, $14.99 per month or $164.89 per year for families, $4.99 per month or $59.88 per year for students, or $7.99 per month or $87.79 for military. Premium offers the full suit of music streaming features we’ve come to expect from similar services. With Premium you get full on-demand listening, unlimited downloads for offline, with the ability to create playlists on your own or powered by Pandora. Premium Family accounts give up to six users their own music library, with all of the Premium features. Likewise, Premium Students get a full Premium account, for half the price, for up to four years. Premium Military is a 20% discount, available to active military, retirees, veterans, national guard, reserves and dependents.

All Pandora tiers compared

Across all plans and monthly versus annual, that’s a lot of plans to get your head around. Below, we’ve sorted through all of the available tiers. Note all of the prices are based on purchasing the subscription from pandora.com. Subscribing through app stores can add additional fees.

- Pandora Free: Free – ad-supported, limited features

- Pandora Plus: $4.99/month or $54.89/year – ad-free, offline listening

- Pandora Premium: $9.99/month or $109.89/year – on-demand listening, unlimited offline listening, make and share playlists

- Pandora Premium Family: $14.99/month or $164.89/year – All Premium features for up to six users

- Pandora Premium Student: $4.99/month or $59.88/year – All Premium features

- Pandora Premium Military: $7.99/month or $87.79/year – All Premium features

How to stream Pandora

Pandora is available across a range of devices, including integrations with more than 2,000 connected products such as smart speakers and navigation platforms like Waze.

- Mobile & tablet (with voice control)

- iOS (with Siri and widget support)

- Android

- Computer

- Car

- CarPlay

- Android Auto

- TV

- Xbox

- Apple TV

- Vizio

- Xfinity

- Roku

- Watch

- Apple Watch

- Google Wear OS

- Fitbit

- Smart speakers

- Google Nest

- Amazon Alexa (with podcast support)

- Sonos

How does Pandora compare with the competition?

Thanks to increased competition, Pandora has changed course over the last ten years to support not only internet radio services, but on-demand listening too, putting them far more inline with the likes of Spotify. But what are the benefits and disadvantages of Pandora in 2023?

- Pros

- Over two decades of Genome Project data

- Free account option

- Ad-free option for $4.99

- Lots of account tiers – annual, plus/premium, family, military, student

- Available on many devices

- Cons

- Only available in the US

- Requires extra steps to distribute

- Limited functionality without paying

- Limited audio quality (up to 192 kbps MP3 with Premium)

- Lower average pay to artists

Find a full Pandora vs. Spotify comparison here.

Artists

How to customize your Pandora artist profile

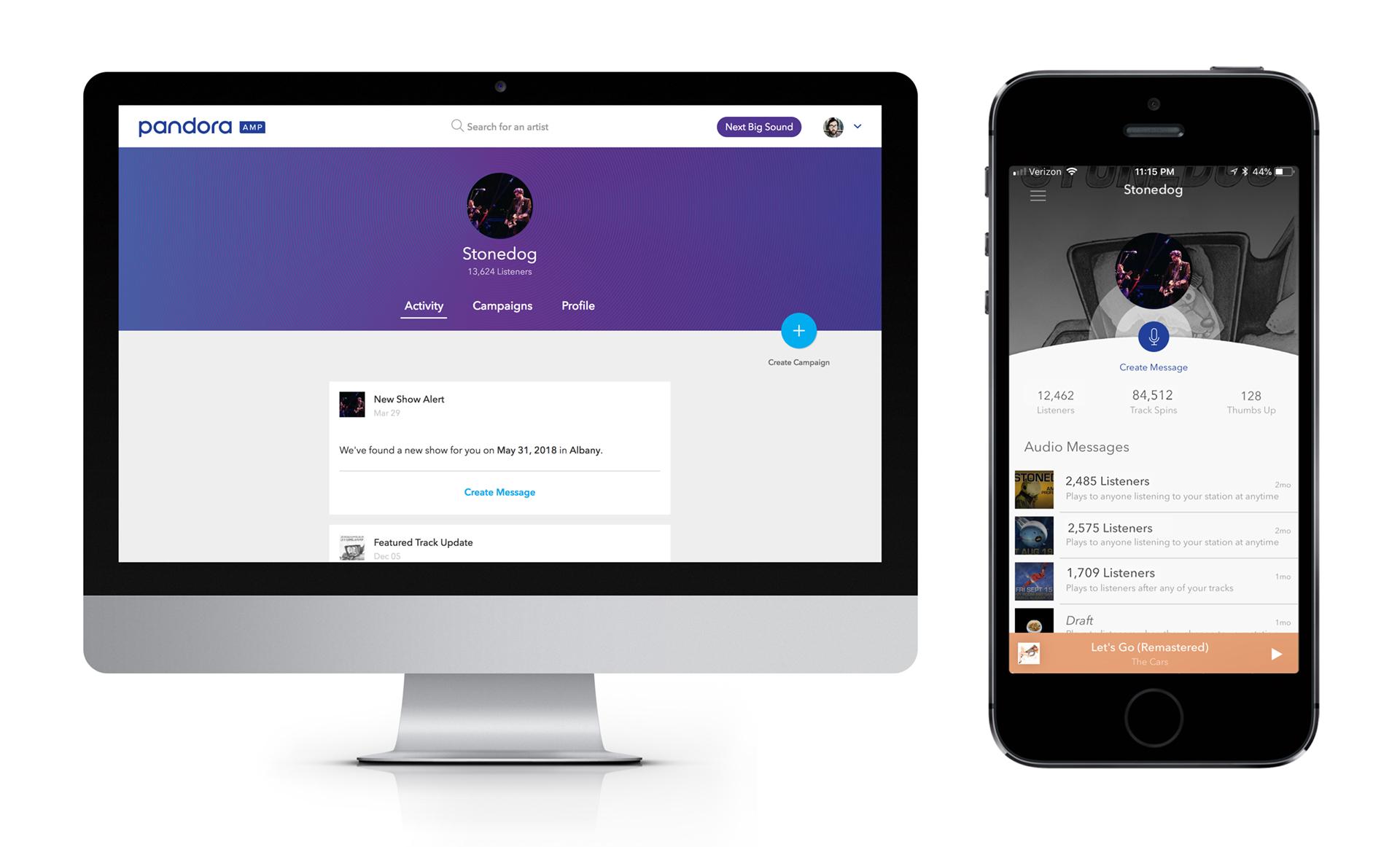

As we mentioned earlier, you’ll need to sign up for an AMP account in order to get your music onto Pandora. Pandora AMP is available to all artists in and outside of the US. Here you can claim your Pandora profile via Twitter or by filling out their form.

Once you’ve claimed your account, artists and podcasters alike can connect their fans, view insights and access free marketing tools. Much like Spotify for Artists, you can view real-time streaming data, such as the number of streams, station/playlist adds, monthly listeners, thumbs up and more!

The fun on AMP doesn’t stop at stats, there’s a whole bunch of other features such as Pandora Stories, Featured Tracks, Artist Audio Messaging, Track Reporting, Artist Insights, Campaigns, Catalog, Creator Notifications, Pandora Charts, Curator Profiles and Pandora Milestones. You can even curate playlists and mixtapes with your commentary explaining the artistic process. Promote your upcoming gigs via an integration with Ticketmaster. Pandora also hosts webinars to teach artists how to make the most out of AMP.

Read our full guide on Pandora AMP to discover how you can make the most of it here.

How to market your music with PUSH.fm

Our friends over at PUSH.fm have a bunch of free promotional tools, so you can market your music, whether you’re a RouteNote artist or not.

Smart Links

One of the common issues faced by artists is, how do you share your music with fans, when there are so many different streaming services? This is where Smart Links come in. A free tool on PUSH.fm, Smart Links gather all of the places where your music lives into one handy, beautiful, fully customizable landing page. You can add as many different destinations into one link as you like, switch the background and change the URL. Create an unlimited number of Smart Links with a free PUSH.fm account.

Statistics

As your audience clicks through to the various stores, PUSH.fm records this performance data and presents it to you in your dashboard. You can see visits, conversions, success rate, growth and much more, broken down by hour, day, year or all time. This information is super important for musicians and creators, so that they can target their audience on future campaigns.

Head to PUSH.fm now to promote your release for free!